The Auction

"Christie's Auction Room", by Thomas Rowlandson & Augustus Charles Pugin from The Microcosm of London, Volume 1 (London: R. Ackerman, 1810).

Located on the south side of Pall Mall, Christie's has been auctioning high end commodities, ancient artifacts, art, jewelry, furniture, and other personal properties since 1762. The sales rooms are large, light, and airy, simply furnished, and tastefully appointed. Pre-auction viewings are conducted and bidding by proxy is allowed. Owned and managed by John Christie.

Going once: A packed Christies sale room looks on as telephone bidders vie for the most important (and the largest) of Monet's Waterlilies, sold at Christie's, London for an astonishing £40.1 million on June 24, 2008, setting a record price for the artist and a record for any Impressionist painting.

DAY 10 Today is Thursday, January 12th, and we are examining the role of the auctions in the art market. In 2012, Christie's will be 250 years old.

How have the bidding room, the buyers, the sellers and the works offered for sale changed in the last 250 years? Just a quick examination of

the two opening images on this page should provide some clues. Read Sarah Thornton's chapter on "the Auction." Choose a recent sale of fine

art at a noted American or European auction house (or their subsidiaries in Asia or the Middle East) – and discuss its significance with regards

to some of the points that Thornton raises about auctions and the players involved.

Sotheby's Price Fixing Scandal

Former Sotheby's chairman Al Taubman and former Guinness PLC chairman Anthony Tennant.

(Photo: From left, Neil Rasmus/Patrick McMullan; Alastair Grant/AP Photo)

DAY 11 Today is Friday, January 13,th and we will probe deeper into the relationship between auctions and the art market through the case of

the Sotheby's price-fixing scandal, which shocked every corner of the art world from 2000 to 2002, when the case was finally settled. Read about

how Sotheby's, led by Chairman Al Taubman and CEO Dede Brooks, colluded with retired former chairman of Christie's, Sir Anthony Tennant, to

fix commission rates charged to buyers and sellers who did business with their respective auction houses. Both firms were charged by U.S.Justice

Department with breaking the Sherman Anti-trust Act of 1890, which was hugely important for safeguarding against under-the-table agreements to

set prices at levels that would not prevail in a competitive market and thusly, preventing monopolies that would hurt consumers by overcharging them

while reaping high profits and slowing production. Comment on at least two ways in which this scandal has (or has not) changed the perception

of the auction house as a necessary and essential place to do business in the art world. In other words, could the art world do without the auction

house and if so, what might that look like?

Readings

Read the following excerpt on "the Auction" from Seven Days in the Art World by Sarah Thornton (New York: W.W. Norton, 2008).

Watch Christie's' Christopher Burge in action selling an Andy Warhol large Campbell's Soup Can, silkscreen, 1962 for $23.8M (including buyer's premium):

http://www.youtube.com/watch?v=boaFiyICN0w&feature=related

Further Reading "Show me the Monet... Impressionist's water lilies go for record £40m"

Listen to author Christopher Mason explain how he began covering the price-fixing conspiracy http://video.cnbc.com/gallery/?video=697473416;

hear Alfred Taubman's thoughts on his meetings with Sir Anthony Tennant http://video.cnbc.com/gallery/?video=697487072; and see some of

the handwritten notes detailing the terms of the "fix" http://www.cnbc.com/id/23812895/ from CNBC's American Greed, Season 2, Episode 16,

"Soaking the Rich at Auction".

Read Orley Ashenfelter and Kathryn Graddy,"Anatomy of the Rise and Fall of a Price-Fixing Conspiracy: Auctions at Sotheby's and Christie's,"

Journal of Competition Law and Economics I (I) 3-20, 2005 http://www.econ.ucsb.edu/~tedb/Courses/Ec1F07/ashenfeltersothebychristie.pdf

and James B. Stewart's, "Bidding War: How an Antitrust Investigation into Christie's and Sotheby's Became a Race to See Who Could Betray

Whom," the New Yorker, Anals of Law, October 15, 2001, p. 158 https://www.msu.edu/course/ec/360/george/Readings/Bidding%20War.htm

Individual Contributions

The art auction process, while seemingly immoral and useless, does actually add a very valuable characteristic to the art market, which is an indicator of liquidity. The auction process creates market value for artists, brings together buyers and sellers, and sets market prices in the most efficient way possible. In the ideal world, there would be many different auction houses, more varied than simply Sotheby's and Christie's, which would add competitive value to the marketplace and help arrive and efficient prices and indicators of value, and so the best consequence of the price-fixing scandal is the economic necessity for other competitors, who advertise their impartiality and objectiveness in determining prices, to enter the market--only with the maximum number of intermediaries can the art market truly function efficiently with the greatest store of value and allocation of resources. If anything, the scandal has positive repercussions for the art market, as it strongly incentivizes increase transparency, accountability, and objective analysis in the market as a whole and in the eyes of the ultimate consumer.

It seems to me that despite the incredible abuse of clients and employee relations in the price-fixing scandal of Sotheby's and Christie's, both auction houses continue to thrive in an economy where culture and social status can go to the highest bidder. The continuation of their legacy after such a political affront appears to be due to an economic tone of the times which equates the sale of art to money and values art by how much it can sell for. In earlier times when thoughts about the value of work were less about making an investment, this kind of scandal would have put both houses into disrepute by their main clientele, the wealthy and prideful. But current times seem more over run by a new kind of buyer, the wealthy and savvy. These new investors have less concern about saving face and more concern about making the most of their investments.

Additionally, if the auction houses, as they exist today, were to go out of business, that would mean bad news for many of the investors who have bought and especially for those who have sold on this market. Other venues for selling art are less democratic, or capitalistic in a sense, because dealers, galleries, and even trading collectors all rely on the symbolic and cultural value of their art (which they give it by NOT selling it). Many of the people who buy at auction on the secondary market, would not be able to make successful purchases on the primary market or even the secondary market run by primary market galleries. Gallery owners and dealers often will sell a work at a lower price into a better collection or institution instead of taking the high price and risking that the work be resold quickly (and devalued culturally).

In a world without auction houses, the idea of art as investment would be less stable and less publicly displayed. It would therefore be a less desirable draw and the infrastructure supporting the market at such record high levels would collapse. The art market, I would say, would return to a more discreet and eccentric group of buyers and aristocrats. The art auction houses add an element of certainty to the prices of works of great art and allow for the valuation of works to come. This is partially though practices of buying in art to prevent it from going unsold at an auction and from the establishment of secret reserve prices set by sellers who wish to insure the value of their art is retained. However, even if the formal auction houses were to collapse, there is reason to believe that they would simply be replaced by an underground alternative. Even before prosecuting the auction houses, the Justice Department was investigating the occurrence of "ring" bidding, were dealers agree not to bid against each other to acquire a work cheap from auction, and then hold a second, secret auction for only dealers.

http://www.artinfo.com/news/story/24595/taubman-memoir-offers-take-on-sothebys-scandal

http://nymag.com/arts/art/features/30620/

http://www.time.com/time/magazine/article/0,9171,996261-2,00.html

The reputation of the actual auction house itself was tarnished yet this also did not seem to lead to any negative impact on Christie’s. After the scandal, the first major auction held in May 2000 was still able to get good prices for the works of art sold that day. It was documented that a surrealist and modern art assembled piece by Rene Gaffe, a Belgian mogul, sold for $73.3 million, almost twice it’s estimated value2. Even Sotheby’s was able to sell successfully after the scandal. Sotheby’s was able to obtain record prices after the sale of Impressionist and modern art that was sold in a New York sale. Because of this, nothing much has changed about the auction house. It is remarkable that the players involved can commit crimes, and seemingly get away with punishments that don’t seem worthy for the crimes they committed. It seems as though the scandal shows that the auction is still necessary. Despite all the negativity associated with breaking the law, people still returned to the auction, still sold and bought pieces, so clearly there is a need for the auction. People still use and benefit from its existence so I think it will be around for some time.

I believe that the art market could do without the auction, however the sales process of art would likely be much slower, and possibly less organized. One of the advantages of the auction is that it allows one to avoid the time-consuming politicking expected by primary dealers, who, in the interests of building their artists’ careers, try to sell only to collectors who have the right reputation. Artists too would likely have a difficult time selling their pieces3. Many artists claim that selling their pieces can be a depressing activity. Because they are associated a monetary value with their pieces the process is comparable to selling one of their children. Essentially it is a difficult process that is avoided via auctions. So with auctions, sales seem much more straightforward and emotionless. Without the auction, it is likely that selling are would become more tedious, time-consuming, and emotionally draining.

References:

- Ashenfelter O, Graddy K: Anatomy of the Rise and fall of a Price Fixing Conspiracy: Auctions at Sotheby’s and Christie’s. Journal f Competition Law and Economics, 1:3-20, 2005.

- http://www.icmrindia.org/casestudies/catalogue/Business%20Ethics/Business%20Ethics%20-%20Ethical%20Issues%20at%20Christie.htm

- Thornton, Sarah. Seven Days in the Art World. New York: W.W. Norton, 2008. Print.

Today’s readings about the price fixing scandal reinforce Thompson’s point in his book that the “art trade is the least transparent and least regulated major commercial activity in the world” (Thompson 29). So I guess it’s not surprising that the auction houses were involved in illegal activity. While it harmed the buyers, the sellers, and the integrity of the auction houses, I don’t think it had a long-lasting or even a significant impact on the art market.

The auction house is a key part of marketing for the whole art world – not just for the auction houses, but for the galleries and everyone else involved. I don’t think the scandal, as bad as it was, changed the perception of the auction house as being essential. I say this for two reasons.

Confidence: First, a perception of confidence must still exist because the fact is that both of the auction houses involved in the scandal are still in business and making a lot of money. Sotheby’s stock trades at $32 a share and has a market value of $ 2.2 billion. http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=BID:US

Christie’s had sales of $3.2 billion in the first half of 2011. Here is a link to their press release:

http://www.christies.com/about/press-center/releases/pressrelease.aspx?pressreleaseid=4940

The continued confidence in the auction house may have initially been the product of the civil settlement they paid. But in the long run I think it had more to do with the fact that both the buyers and the sellers want the auction house system to remain in tact. So even if the art market could live without the auction house, I don’t think anyone involved wants to do away with it.

Auction houses still do business as usual: Christy’s did not fire high ranking executives who had knowledge of the price-fixing. Instead, many of them were promoted and some received multi-million dollar bonuses (Stewart 15).

For 2 – 3 years after the scandal broke, Sotheby’s stock value dropped a lot and was only worth a few dollars a share. But aside from the drop again during the middle of the recession in 2009, the stock is now worth almost as much as before the scandal. To me, this means that the auction houses easily handled the problem and probably looked at it like a cost of doing business. Also, it shows that there is no perception that the market can do without the auction house. To the contrary, and even if its not essential, the people involved in the art market want and need the auction houses to continue growing business. If the perception was that the market could do without them, they probably would have closed down after the scandal.

Here is a graph of the history of the stock price for Sotheby’s, which uses the symbol BID.

My opinion is that without the auction house, the art market would not be as successful as it is today. Anyone agree?

The perception of the art auction system has been almost entirely informed by the two-party relationship between Christie’s and Sotheby’s from their creation. Had Christie’s managed to eliminate Sotheby’s and essentially create a monopoly, the consequences may have changed the position of the auction house in the art world by eliminating the already scarce competition and driving up prices even more. Through negotiations and cooperation with the lawyers handling the civil suit for Christie’s and Taubman paying a substantial portion of the settlement, Sotheby’s managed to survive.

As concluded in the paper by Ashenfelter and Graddy, the price-fixing had minimal repercussions for buyers and so the demand by buyers on the market was not significantly affected. If buyers had been seriously injured I think there may have been an outcry that could have damaged the auction houses. While the sellers were injured as well as the individual players at the top (Tennant, Taubman, Davidge, and Brooks), the auction houses themselves managed to maintain their reputations as a whole.

I think that it is possible for the art market to continue doing business without the auction house but I do not think it would manage as effectively (or lucratively). Buyers and dealers would have to put much more of an individual effort into finding the art that they wanted or patrons to sell works to. The auction system is very convenient for most of the parties involved and keeps the art market moving at a swift pace. It would not be in the interest of these parties for the auction houses to disappear, and I believe this is a significant reason for the houses coming out of the scandal relatively unscathed.

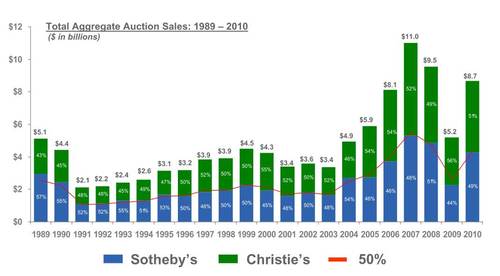

I think that all the discussion of antitrust law is ironic when the power held by these two auction houses really amounts to a monopoly to begin with. As they are, I do not know that Sotheby’s and Christie’s would meet the criteria of open competition as defined by the Sherman Antitrust Act. For example, antitrust law was used recently (and successfully) to block AT&T from acquiring T-Mobile in what would result in the narrowing of the cellphone market to three main providers which would decrease competition. If this is the case for the cellphone market (as well as many others), how can it be that only two auction houses are allowed to influence/control the art market unchecked?

http://www.artsjournal.com/culturegrrl/assets_c/2011/08/AuctMrkShr2-thumb-500x276-20343.jpg

The tactics of Sotheby’s and Christie’s to attract big sales by big sellers do not seem to have changed after the scandal. They continue to grant sellers guarantees (promised sums of money to be paid to sellers regardless of a sale’s outcome) and share of the premiums paid by buyers. With constant competition over the dominance in the art auction world, the rivalry between Sotheby’s and Christie’s doesn’t seem to ever end. According to one art market blog, the auction houses even wave their fees “in an effort to secure the sale of a particular artwork or collection just so they can get the resulting publicity and kudos” (Forrest).

Christie’s made a controversial purchase in 2007 of the gallery Haunch of Venison is another evidence of the rivalry that exists between the two auction houses. The purchase was criticized for causing a “conflict of interest” by “blurring the lines between what galleries and auction houses offer” (Forrest). Christie’s successful venture in purchasing a gallery would have proved that Christie’s could do what Sotheby’s couldn’t.

I also think that, the ostentatious and often pretentious behavior of the people who take part in auctions has its part in the success of the two auction houses. They delight in the appeal of the spectacle the auction houses offer, and it’s possible that their continued engagement in auctions have more to do with themselves, how important, how rich they want to feel and want to be viewed as, than it has to do with their confidence or trust in Sotheby’s or Christie’s.

If the art world were to rid of auction altogether, buyers as well as sellers would have to trouble themselves with slower and more cumbersome procedure to sell or buy art. Especially with auction houses now selling contemporary art by living artists, some contemporary artists will face more difficulties in raising their market value if the auction houses did not exist. Collectors would have to rely on secondary market to buy art, which can be troublesome because the galleries are selective as to whom they sell. Thus, the survival of the auction houses seem to be based on all actors’ needs and it is unlikely that auction houses will collapse beyond repair.

Works cited

Forrest, Nic. “Art Market Scandal: Sothebys vs Christies, In the red corner…” Art Market Blog with Nic Forrest. 22 Jun. 2007. Web. 12 Jan. 2012. <http://www.artmarketblog.com/2007/06/22/sothebys-vs-christies-in-the-red-corner/>.

Rosenbaum, Lee. “Market Share Reversal: Sotheby’s Edges Out Christie’s in First-Half Global Sales.” CultureGrrl. 3 Aug. 2011. Web. 12 Jan. 2012. <http://www.artsjournal.com/culturegrrl/2011/08/sothebys_edges_out_christies_i.html>.

It seems that Christie's and Sotheby's together offer something that no other art market institution can. They are the barometer for the value of secondary market artworks. Auction sales make blockbuster headlines, wealthy collectors are able to compete over highly desired works, and the rest of the art community looks to these auctions as a means to gauge the market. This is in part because Christie's and Sotheby's have dominance over the secondary art market. It would be difficult for the art world to find a reliable indicator if these major sales were done by many smaller auction houses or individual galleries. Buyers can be reassured when they buy from these houses. As Thornton notes in her article from our last class, “All art is priceless, but assurance is expensive” (13). So in this way I think that the price-fixing scandal has not really changed public perception of the auction house, as it will remain a barometer for the secondary art market that most people rely on.

Despite the fact that buyers took most of the loss in connection with the price-fixing scandal, the Ashenfelter & Graddy article points out that, “it is unlikely that successful buyers as a group were injured” (3). So it appears that the major consequence of the scandal may perhaps motivate buyers to be even more competitive. Buyers already know that they are in competition with everyone else at the auction, and that its main goal is to make as much profit off of them as it can. Even the auction houses estimates do not reflect or influence how much buyers are willing to spend. A recent article in the LA Times is titled, “Christie's: Elizabeth Taylor $137-Million Auction Makes History.” A representative of the auction house told the paper, “It was the most valuable jewelry sale in auction history.”

http://latimesblogs.latimes.com/gossip/2011/12/elizabeth-taylor-kim-kardashian-jewelry.html

With sales like this, I would say that the auction houses have not lost buyer confidence, and Christie's and Sotheby's are likely to keep their institutionalized status.

Bibliography:

Thornton, Sarah. Seven Days in the Art World.

https://www.msu.edu/course/ec/360/george/Readings/Bidding%20War.htm

Sotheby's and Christie's are two of the largest and most well-known auction houses in the world, and in the mid 90's neither were making enough money from sellers' commissions to keep their large art empires afloat, therefore they decided to enter a price-fixing pact, whereby each auction house would offer the same commission rate. FBI Investigations of the auction practices revealed that the two companies were in collusion. Both of the CEOs Diana Brooks, and Alfred Taubman were found guilty and were forced to step down from their positions. Taubman spend ten months in jail, and Brooks spent six months in home confinement. Both were charged a monetary penalty, and both auction houses were required to pay a total of about half a billion dollars together, to make up for the money taken from sellers.

One would think that after this huge conspiracy, people would be less inclined to use the auction houses to sell and purchase their art, and thus the companies would suffer, but this was not the case. In fact, the art market was not affected, both auction houses continued to prosper. The only people affected by this price-fixing, were the CEOs themselves, and the auction houses, but only in that they had to pay back the money that they had illegally received. It would make sense if people had lost their ability to trust the auction houses, and thus chose to sell their art pieces elsewhere, however this also was not the case.

I believe that people expect a certain percent of corruption from large businesses like these auction houses, and thus were willing to overlook this injustice because it was not surprising. Not only that, but I also believe that in the minds of some large art consumers, the idea of buying a piece at a world famous auction house increases the worth of the piece itself, and they would not trust the authenticity or worth of a piece of art were it not sold by one of these large auctions. This, coupled with the idea of an open auction where you are bidding against other avid art fans, provides the incentive to spend more money on a piece, and thus art auction houses have not been hurt by these charges of participating in illegalities.

Sotheby's and Christie's are also not alone in their corruption of selling art, many other world famous art auctions have followed suit and in 2010 France's most profitable auction site was also exposed, but for a different corruption. They had been housing an extensive art-trafficking ring. You can read more about this here:

http://www.nytimes.com/2010/04/27/world/europe/27paris.html

Although the art auction house is, by nature, a corrupt place, where the companies only care about themselves, and their profit, many people believe it is necessary to the art market, and I somewhat agree. It is necessary right now, because art enthusiasts regard it as the premiere place to purchase and sell art, thus it is believed that it gives the art bought and sold there, a higher quality, and thus a higher value. Eventually it would be wise, and doable to rid the art market of these auctions, however there would need to be another place to purchase and sell art with the same allure and prestige to take its place.

Price-fixing violates the principles of a fee market economy. The social benefits from price fixing are thought to be small or nonexistent. The conspiracies involved in price fixing are unstable and unlikely to be effective in maintaining artificially high prices. Christie’s was a privately held company while Sotheby was public and this might have led to price fixing activities, because it was not only sued by the costumers but also by the shareholders. The fact that Christie’s was a privately held company meant that the large fine clearly affected the value of the company and its major shareholders. As people became used to buying art for high prices, these companies decided to make money off their clients and take advantage of them. In so doing they made an agreement that the more a painting sold for, the more commission the house will receive in so doing they both shared the information of their clients including their salaries. With this information they could carefully examine their bidders with attention and in detail. Auction houses appear to conduct auctions in a manner that suggests that art buyers are unable to make decisions for themselves when buying at auction, and need to be told what they should be buying.

With this said, could the art world do without the auction house? I hope they will because they can, but it doesn’t look like that is what is happening. It is reported that Sotheby's made a profit of $96.2m, or $1.38 a share, up from $73.6m, or $1.09 a share, a year earlier. I don’t think that art buyers and collectors have decided to forfeit the idea of auction houses, go through all the hustle and tussle to make new choices in finding out the best way to buy their art. They have become so accustomed to the tradition of auction house art buying that they have nowhere to go-so to say. The auction houses are also not ready to forgo their business and are trying every tactics to keep the art world under their belt. Here is the case where auction houses are now on the Internet making their money from the art buyers. Where else will the art world to buy art? The Gallery? The galleries are no different when it comes the quest for making money. I think that the art world, buyers and collectors have acquainted themselves with the structure and fanciness with which the auction houses have presented to them that they are in love with it. Actually I should say that in the last two years, auction prices have skyrocketed and buyers are eager to bid as much as they can to get it. These people are all part of the game; they together with the auction houses control the art world.

Now if we want to do away without the auction houses, we certainly can. We will have to build and trigger the confidence and trust within our selves, where by the young sought-after artist begin to work together without expecting a market mechanism to be looking out for them and managing their careers. The bait of financial gain and international recognition can be intoxicating and should not be part of the new move if we really want to do away with the auction house.

In 2000 Christie's ratted on Sotheby's by providing "information relevant" to the Justice Department, just weeks after Christie's chief executive, Christopher Davidge, hastily resigned. Davidge was followed by the two top officials of Sotheby's, A. Alfred Taubman, the chairman and largest individual stockholder who bought the firm in 1983 and took it public in 1988, and DeDe Brooks, its chief executive. The scandal unwrapped that Sotheby’s and Christie’s had been in cahoots to fix commission prices.

Auction houses charge two commissions on sales--one from the buyer, the other from the seller. It's perfectly legal to drop or raise prices after a rival does; gas stations facing off across an intersection do it all the time. What's illegal is for two or more rivals to form an alliance by agreeing in advance to fix a price. One of the signs that this was happening was a pattern of changes in the commission between Sotheby's and Christie's. In 1992 Sotheby's raised its buyer's fee from 10% to 15% on the first $50,000 (on higher amounts the buyer paid 10%). After just seven weeks, Christie's announced an identical fee rate. Three years later, Christie's took the lead by changing its seller's fee from 10% to a sliding scale of 2% to 20%. After a few weeks, Sotheby's did the same thing.

I don’t believe the long-term effects of the scandal have changed the perception of the auction house. Despite the broadcasted series of events, the investment and participation in the auction houses has not significantly declined. Shortly after the scandal Christie's announced a new fee structure, raising the amount buyers must pay to 17.5% on the first $80,000 and 10% above that but reducing the seller's commission for customers who buy a lot of art. Sotheby’s took longer to announce changes but reshaped itself into a monopoly. The major affect of the scandal was that dealers hoped that clients would buy more through them and less at auction. Although dealers sold the idea of a relationship with someone you know and can trust, there was still much appeal to the importance of live auctions. Although Sotheby’s almost went bankrupt buyers were not very hindered.

As Ashenfelter and Graddy concluded, the price-fixing had minimal affect on buyers and so buyers were not hindered to continue to buy through the auction houses. Because the auction system provides incredible artwork that sometimes galleries cannot, there is still a market for the auction houses. I also there is more comfort in buying through an auction house as it is an established company, rather than a private gallery that seems less legitimate.

The interesting part of the scandal is that before the price fixing, the rates were not done in an appropriate way either. Auction houses would essentially bid for business themselves by appealing to the seller, often donating to a possible seller’s charity to win business.

Despite the scandal, many aspects of the auction system remained the same.

One would expect that after the price fixing scandal, collectors and sellers would feel betrayed. The high-end art buying community is relatively small, and a backlash in confidence could drastically affect business. However the scandal did little to bring down business. In 2010, Christies sales totaled over 3.3 billion British Pounds. The auction houses had little effect on the confidence in their business. In fact, in 2007 the auction houses expanded into the primary market, acquiring private galleries.

The buyer’s premium which is a fixed percentage of the auction price to be tacked on to the sale is not only here to stay after the scandal, but is being expanded upon. There is a currently a bill proposed in Congress which would set a percentage buyer’s premium charge to be dispersed from secondary market sales to the original artist (if living).

My question to the class is how do you force fair rates in a two competitor system? There is such prestige at being sold at one of these auction houses that an emerging auction house might not even have a chance to compete.

Auctions provide a key location and market crossroads for these observations to take place. The reading concerned itself with Christies, arguably the premier auction house in the world, especially in its New York location.The entire process, from the "specialists" to the methodology of the sale to the auctioneerChristopher Burge, is designed to achieve the maximum bid possible as a result of the proceedings. The auction house take a percentage as commission, perfectly aligning the auction house's interests with value maximization, which, on paper, should be equivalent to the interests of the artist or vendor. This mindset represents the majority of the auction market, as Sotheby's and Christies together represent an astounding 98% of the auction market. The auction houses have often built personal relationships with many of the key buyers, knowing in advance which are likely to bid and able to provide reliable estimations of final price. The auction house is set up to produce a "high society spectator sport," with the actual bid representing as much of a status symbol as the ownership of the art itself. There is a much-described "rush" or burst of adrenaline when a bid is made in front of all the prestigious watchers and an even greater artificial high when the painting is "won." Winners of art will be published in art magazines and other publications for regular circulation, as the mere ability to buy an expensive work of art generally carries greater value than its ownership or display. Huge names can suddenly produce intense fluctuations in art; for example, the "Larry Gagosian Effect" occurs when rumor states that Gagosian is about colllect another artist in his gallery, and everyone immediately attempts to purchase art, in anticipation of skyrocketing prices -- Gagosian often "protects" his buyers at auction with large bids. Many artists protest this impersonal portrayal of art, rejecting the "asset" vocabulary of the new commodity, often not attending the very auction in order to maintain their "purity." Others, such as Hirst, welcome the superficial demand created for the art and the higher economic value it carries, and have profited from it due to market savvy and ability. Dealers, seeking to promote their artists, often won't sell to collectors known for "flipping" art in auction settings, as they generally view the auctions as immoral or evil. Furthermore, auction prices can wreak havoc for an artist's career: a singular high price can set unrealistic expectations for the artist's future, and failure to meet these prices in the future could result in swift loss of demand for the artist's later work. On the other hand, high prices can catapult an artist into the public eye, but failure to sell and having the artwork "bought-in" by the auction house can produce humiliation to a career-ruining degree. Other players, such as art consultants who gain commission for he purchase of paintings for wealthy collectors, serve to exacerbate the situation, as their job revolves around inflating the prices of artwork to the maximum extent through salesmanship, flattery, or exaggeration. Auctions ultimately provide the illusion of liquidity, which in turn produces confidence, creating an increasingly subjective and artificial market -- many artists doing well now will have zero value in ten year, as auctions have short memories.

This is the first time since the 1950s that art has been shown to this much fanfare. Prior, artists like Picasso made their careers in the private sphere, seeking to find patrons themselves who would support and commission art, and deliver the artist to prominence. Now, the high spectator-aspect of art, as well as the abnormally high returns and ongoing bull market which has propelled it it into a relatively attractive investment opportunity, art has converted into more of a commodity that a product with unique intrinsic value. Time lags between the studio and the resale market are decreasing, as secondary markets are gaining prominence and collectors are increasingly seeking to purchase art for the return on value rather than its ownership and appreciation. In fact, there is a shortage of supply, as consumer run out of early or ancient works and consequently are constantly seeking newer, younger art. It is a buyer's market, but a commodity market with its individual piece losing unique value.

An example of a gigantic Christie's sale is the 2008 sale of Monet's Le Pont Du Chemin de fer a Argentuil for $41.8 million. The auctioneer waits over 90 seconds before accepting the final bid, almost twice as long as the entire previous auction, in an attempt to expertly eke out the absolute highest bid possible. It is a very tense minute and a half, as everyone seems to be looking at everyone, sharing disbelief at the price and excited at the prospect of such a large sale--you could almost hear a pin drop. The buyer ultimately remained anonymous, but whether he elected to eventually reveal himself is unclear. The high price could perhaps be explained by the fact that this was a very old painting, by normal contemporary auction standards, and the fact that there is very little current supply of traditional paintings means that they can command a high premium when lured out of collector's mansions. A picture of the painting is below, as well as the video of its sale.

Watch the sale:

Cady Noland - Oozewald, 1989

The Image is Oozewald, an installation sculpture by Cady Noland created in 1989. Cady is considered to be an influential member of the art world in the late 1980s and early 1990s. She then promptly removed herself from the art market. This move has made her work scarce and has left a place for her work to grow in value as the demand can potentially exceed the supply which has ceased to increase. An article on the political significance on her work highlights the importance of her American political commentary and the minimalistic movement.

In November of this past year, her above sculpture sold for more than double the high estimate of the action at Sotheby's in New York. The estimated low of $2, high $3, and selling price with buyer's premium of just over $6.5 million. This is a prime example of the premium prices being demanded in the auction house market by established collectors, dealers, and advisors. The market is in a bubble. Prices are soaring for contemporary works, and these works are being traded by powerful players for extreme monetary gain.

There are some collectors who do not resell the work they buy, but prefer to hold onto it as selling can be taboo. However, this behavior is mostly indicative of the primary market where works by young new artists are sold for the first time. In the auction houses, with the rare exception of incidences like Hirst's selling of the Pharmacy works, the pieces going up for sale are on the secondary market and are thus thought of more as an investment opportunity than a sentimental buy for people looking to enrich their art portfolios.

Sotheby's Auction House

Until recently the art of living artists was sold privately, with only work by masters on the public radar. The prices of the privately sold pieces were thus not necessarily common knowledge. With the recent trend in the auction houses of selling contemporary art, though usually no fresher than 2 years old, an artist can be branded by the auction house and this branding will inevitably raise the price of their work. People publicly see the new artist among their respected and established peers and ultimately associate that young artist to be of the same caliber (and price range). Yet when an artist like Cady Noland stops producing art work, it is like she has died and the supply of new work by her has been cut off from the market. Therefore when her work comes to the lot, there is the palpable tension created by scarcity and the "need to buy the work now".

Where the market used to thrive on the work of the great masters, a scarcity effect has limited their sales as well. Since the masters are long gone, and museums or other institutions are starting to collect their pieces, it is rarer and rarer to see them offered up at auction, as many people are unwilling to let them go. When they do happen to be released, unprecedented bidding wars have broken out causing record high prices and a sense of urgency on the part of the buying party. This being true, the market is moving towards offering more and more young artists because they are "running out" of work to put up, and being forced into a more contemporary market within the houses. Also, because the masters are being held and the contemporary works are being traded, many financially savvy collectors are seeing the art market as a mode for investment with quick, steep returns when their taste is right (or their advisors are good). Art investing is a more recently pervading fad. Before where the only acceptable reasons to sell in the art world were the 3 Ds, a 4th D for dealers has been added where many are selling for money.

A large blue and white archaistic vase of the Ming dynasty, Wanli mark and period (1573-1620) had a Lot 67 estimated price of 200,000-300,000 EUR. Also in this collection was a blue and white dragon basin from the same reign with an Lot 68 estimated price of 150,000-200,000 EUR and a Ming Dynasty, Zhengde mark and period (1506-1521) yellow ground and underglazed dish with a Lot 75 estimated price of 150,000-200,000 EUR.

In the excerpt from Sarah Thornton’s book, Seven Days in the Art World, she discusses the experience at an auction which revealed several intricacies to the whole process. One major characteristic of auction is that it is a place where “the art world [gets] its financial value. [Auctions] give the illusion of liquidity”. This is very evident by the fact that works of art at auctions are reduced to pieces of monetary value. This is also present by the sale of the pieces from the Art’s D’Asie collection. These works, dating back to the Ming and Qing dynasty, are reduced to their monetary value rather than being appreciated as valuable, historical, art. During the Ming Dynasty, culture developed rapidly and the economy sold many commodities including porcelain. Before the 16th century, the Ming dynasty was even a leading country in scientific development. Then, by the middle of the 18th century the economy of the Qing dynasty had reached its peak and spanned three emperors including Emperor Qianlong. This age was called “the golden age”. Works from both these dynasties has great value and have historical implications greater than just monetary value.

It is likely that they were obtained quickly, within minutes like at a typical auction. In the excerpt, Thornton notes that items that are successfully sold are done so in minutes. Deals are made quickly, and serious collectors usually do the purchasing. In the words of Amy Cappellazzo, Christie’s international co-head of postwar and contemporary art, “art is more like real estate than stocks”, implying that there are different degrees of wealth that can be obtained and displayed through the purchase of art. One can gain riches and display his or her wealth with a condo, or with a penthouse. Stocks are always stocks, simply with different values. Buying the items in the Arts D’Asie collection may reflect this notion. The collection may provide a serious collector with a quick, non-time consuming means of collecting art from a powerful time in history, without having to deal with primary dealers and the red tape associated with interacting with them. With this art, they can work towards increasing their status in the art world and monetary value. After all, auction is a “high-society spectator sport” where people go to be seen and meet and greet “the money”.

Some of the works in the Art's D'Asie collection:

On the left is a porcelain vase from the Qing Dynasty

On the right is a porcelain plate from the Ming Dynasty

References:

Thornton, Sarah. Seven Days in the Art World. New York: W.W. Norton, 2008. Print.

http://www.travelchinaguide.com/intro/history/ming.htm

http://www.travelchinaguide.com/intro/history/qing.htm

http://www.sothebys.com/en/auctions/2011/arts-dasie/overview.html

The auction house of today has it’s own kind of branding and marketing. What I mean by that is it seems the auction is as much about the star power of the auction house, its auctioneer, and its clientele, as it is about the work being auctioned. It looks so easy to get caught up in the moment and spend more than you ever wanted to – which I believe is a product of successful marketing by the two major auction houses.

An example of a recent and notable sale is Roy Lichtenstein’s I Can See The Whole Room…And There’s Nobody In It! It sold for $43.2 million at Christie’s in November, 2011.

Here is a video of the piece being auctioned off at Christie’s:

After watching this video of the piece getting auctioned off, I realized how well the reading describes the typical auction. The Lichtenstein piece was auctioned off at Christie’s by Christopher Burge. His charming personality as described by Thornton is seen in the video. While he does seem to have “tight control over the room” (Thornton 5), he has a way of engaging the crowd that keeps everyone involved, whether or not they are bidding. I think any major auction ar Christy’s or Sotheby’s is really well described by Thornton who calls it a “high-society spectator sport” (Thornton 9).

Burge does a good job at spreading the energy throughout the bidding room. "People who buy at the auction say that there is nothing like it: your heart beats faster, the adrenaline surges through you” (Thornton 10). In the reading, Thornton explains that before the auction, Burge studies the background of the potential bidders. Although Thornton mentions that Burge has a script to read from, it doesn’t seem like he is doing so. The auction “crowd is international” (Thornton 12), which explains the display shown in the Lichtenstein sale video that has many different currencies. Burge, with his British accent, makes a good auctioneer as it brings a sense of Europe to the American auction.

Does anyone else think the excitement generated by a high profile auction in and of itself causes people to bid higher?

Here is a link to a website in which Sarah Thornton comments on the Lichtenstein sale: http://blogs.reuters.com/felix-salmon/2011/11/21/why-you-cant-always-trust-auction-results/

Here is a link to a Wall Street Journal article about the sale: http://online.wsj.com/article/SB10001424052970204190704577026963186239408.html

I suspect that similar to the contemporary art auctions that Thornton described, the Latin American art patrons are an insular group in which, “With few exceptions, everyone sits in exactly the same spot they did last year.” While much of the Latin American art for sale is very significant and fine quality art, the market is not nearly as strong as that for contemporary art, for which a sale on November 9, 2011 brought in $315,837,000. The “specialists” involved in the Latin American art auction were Carman Melian, Ana Maria Celis, and Andrea Zorilla. Melian had an important role in the 2006 sale of Frida Kahlo’s “Roots” which was a record sale for Kahlo’s work at $5.6 million. As mentioned by Thornton, the catalogue is the main marketing tool for the auction. For each piece, the catalogue for this auction included a color picture, provenance and exhibitions, a list of literature regarding the artist, and a “note” that provided a brief biography of the artist and description of the work.

By comparing the images of auctions by Christie’s in 1810 and 2008, and Thornton’s reading about auctions, it becomes clear that the auction world has changed in some ways. The auction room appears to be much more organized (assigned seats) and crowded, with less room for movement in its current state than in the past. Much of the art displayed on the walls has been replaced by television monitors and a “scoreboard or currency converter.” While many buyers and sellers surely have similar motives to those of the past, I think there is presently a stronger emphasis on art as investment. In addition, buyers can now participate in an auction without being present through the use of phones and the internet which obviously was not possible in 1810. The type of work sold at auctions has also changed. Before the 1950’s, art by living artists was not commonly sold in auctions because, “living artists are perceived as unpredictable and inconvenient.” This has changed drastically as much of the art now sold is by living artists and the demand continues to rise.

Here is a link to a Youtube video of the most recent auctions of Latin American Art by Sotheby's and Christie's in New York: http://youtu.be/NxQW2RiuIwM

Here are Tamayo’s “Watermelon Slices”, Botero’s “Ballerina” and Ramos Martinez’s “La India del Lago” sold at the Latin American art auction at Sotheby’s last November:

This ceremony that is auction reminds me of the culture of lavish spectacle in 19th century France. The wealthy in the 19th century France went to the theatres not to see but to be seen, and the same seems to apply to the ritual of auction-going today. Thornton hints that people care considerable amount about what they wear to the auction (Thornton 16). As vain as these auctions have become, where they sit in the auction room is terribly important to the bidders because the location of their seats is a “mark of status and a point of pride” (Thornton 16). For buyers, buying is “winning” and the prize won acts as a testament to their wealth and status. For consultants and dealers, buying is an “advertisement for their services” (Thornton 26). There are understood rules in the auction room that are to be followed closely if one did not want to suffer from public embarrassment. This NY Times article spells out these rules: http://www.nytimes.com/2006/11/05/arts/design/05alle.html?pagewanted=all.

http://www.cartoonstock.com/lowres/vsh0341l.jpg

Another thing I learned is how big of a role an auctioneer plays in the game. Thornton’s account of Christopher Burge was fascinating. I always saw this job as one of the most boring (to which he agrees) and unimportant because all that I ever saw auctioneers do was yell out numbers and banging their gavels. To my great surprise, Thornton reveals that the auctioneer has the “book” that contains all kinds of useful information like the seating chart of all bidders and their bidding behaviors (Thornton 4). I had no idea that the auctioneer knew so much about the bidders beforehand. Using the knowledge he has, an auctioneer can also influence the final price of an object being auctioned off. He is also responsible for picking up signs from the discreet bidders who bid with the slightest gestures (see cartoon). Christopher Burge’s charming, lively disposition, direct eye contact, and calling bidders by their names, all of which can push the bidders to bid higher, can be shown in the YouTube video clip of the auction for Andy Warhol ‘s Soup Can with Can Opener.

According to the Economist, Warhol’s Soup Can with Can Opener was the first of Warhol’s works that were ever shown in a museum and was once owned by the Tremaines (The Economist). So this work has historical significance and desirable provenance. However, another Warhol that had been mostly neglected beat it with a much higher price tag. This hidden card was Warhols 1962 work Men in Her Life, which dealt with “celebrity, wealth, scandal, sex, death, Hollywood, icons of American life” (Artdaily). Its estimate was only available on request, which, according to Thornton, is the case for extremely expensive works. Whereas the Soup Can with Can Opener was sold at $23.8 million, Men in Her Life went as high as $63.4 million. The latter lacks color and was passed from one dealer to another for decades. How can a work like this fetch such a high price? The answer lies with Philippe Ségalot.

Philippe Ségalot, a co-owner of a powerful art consultancy, is an art advisor to some of the richest collectors. When an auction house Phillips de Pury opened a new space on Park Avenue and 57th Street in 2010, Ségalot organized Carte Blanche, a curated auction for which he put together 33 works, including works by Cindy Sherman, Maurizio Cattelan, Robert Morris, Takashi Murakami, and Andy Warhol (Vogel). Ségalot bid against his own assistant and business partner among others and bought the work for the staggering $63.4 million (The Economist). This auction is interesting because one can look at this concept of "curated sales" as either a strategy of an auction house to outshine its rivals or an attempt to select artworks "not for their market value but for their artistic quality," as Ségalot claimed (Artdaily). Whether the fact that Warhol's Men in Her Life beat the Soup Can supports or undermines Ségalot's statement is debatable.

Andy Warhol. Men in Her Life. 1962.http://media.economist.com/images/images-magazine/2010/11/13/BK/20101113_BKP504.jpg

Andy Warhol. Soup Can with Can Opener. 1962.https://encrypted-tbn0.google.com/images?q=tbn:ANd9GcS6CUfwb5BsG__-Izop6VV_Lpjl_6tvomwYckvdM1HoTnnu-k9t

Works Cited

"A Passion That Knows No Bounds." The Economist - World News, Politics, Economics, Business & Finance. 19 Nov. 2010. Web. 12 Jan. 2012. <http://www.economist.com/node/17551930>.

"Phillips De Pury & Co. to Launch Carte Blanche Auction at New Space on Park Avenue." Artdaily.org - The First Art Newspaper on the Net. Web. 12 Jan. 2012. <http://www.artdaily.org/index.asp?int_sec=2&int_new=41369>.

Thornton, Sarah. "Auction." Seven Days in the Art World. New York: W.W. Norton, 2008. 3-39.

Vogel, Carol. "Phillips De Pury Wants to Make a Big Splash." Rev. of The New York Times. The New York Times. 27 May 2010. Web. 10 Jan. 2012. <http://www.nytimes.com/2010/05/28/arts/design/28vogel.html>.

The auctioneer, who whose role used to be more like that of a mediocre salesman amidst a slightly distracted audience, is now a trained conductor with the room at his attention. Christie's chief auctioneer, Christopher Burge, exemplifies the profession's evolved role. He has a reputation for being “genuinely charming and having tight control over the room” (Thornton, 5). As Burge explains his selling strategies, one may call to mind the world of sports or gambling before art. Burge discloses that he keeps a book recording the seated positions of the bidders and their bidding styles, whether they are aggressive or looking for a deal (Thornton, 4). He also credits his ability to read bidders body language after years of experience (Thornton, 21). As a result, Burge and other experienced auctioneers, have a good sense of how things will turn out before the auction begins.

The buyers have changed as well. The auction house used to draw informal crowds engaging in some casual window shopping and light socialization. Today's buyer is much more focused. Some see the event as a serious business transaction by which to diversify their investment portfolios. Others are serious collectors constantly looking to acquire new works to keep them at the top of their social circles. Many attend for a combination of both reasons.

Other factors have changed since Christie's opened. The works offered at auction tend to be quite recent. As Thornton notes in her first chapter, primary concern is not for the meaning of the artwork but its unique selling points, which tend to fetishize the earliest traces of the artist's brand or signature style.” (Thornton, 7).

The bidding room itself is has changed from the greyish-green ideal of 18th century gallery interiors to the stark minimal white that is the standard of today (Klonk, 28). Additionally, the condensed arrangement of paintings characteristic of 18th century displays has given way to a focused and separate display of each work (Klonk, 30).

A recent auction at Sothebys was marked by some the typical attributes of the contemporary auction as noted in the Thornton article. Klimt's Litzlberg on the Attersee made $40.4 million, well above the estimated $25 million it was expected to generate [1].

Link to image here: http://www.nytimes.com/2011/11/03/arts/design/sothebys-art-auction-totals-nearly-200-million.html

Though Sothebys auctioneers likely use the same statistical methods that Burge describes, this is proof that the market is often unpredictable when those with unlimited financial means are involved. The article also points out that sale had more modernist material than recent sales. L'Aubade by Picasso sold for $23 million.

Link to image here: http://www.artnet.com/magazineus/news/artmarketwatch/sothebys-impressionist-and-modern-sale-11-3-11_detail.asp?picnum=5

This resonates with Thornton's observation that serious collectors tend to buy newer works because they want to stay ahead of the curve (Thornton, 13). This may also help explain why, aside from the Klimt painting, the other top grossing sales were from the modernist paintings. Though these modernist paintings aren't exactly new, perhaps this is a compromise between the uncertainty of the primary art market and the desire to have more recent work.

Bibliography:

[1] http://www.nytimes.com/2011/11/03/arts/design/sothebys-art-auction-totals-nearly-200-million.html

[3] http://www.youtube.com/watch?v=boaFiyICN0w&feature=related

Klonk, Charlotte. Spaces of Experience.

Thornton, Sarah. Seven Days in the Art World.

The word "auction" is derived from the Latin augeō, which means "I increase" or "I augment". '.

The auctioneer is of great importance in auctioning, because not only does he have to sell, but must entertain as well, while psychologically analyzing and influencing the buyers, through hokey language. It has been structured as a celebrity ceremony with just a means to convince people to buy. I picture a bunch of brainwashed rich aristocrats who for not only selfish, but also ignorant reasons have been bamboozled to think that their act of buying an artwork elevates their status. To me the statement made by Sotheby staffer “we don’t deal with artist, just the work, and it’s a good thing too……….” Because they are a pain in the ass, really strikes me as a selfish act from all the people involved in auction and I hoping this is not the same with art dealers, museums and galleries.

“The artist is the most important origin of a work, but the hand through which it passes, are essential to the way in which it accrues value” (10). This quote here means a lot and is directly linked to what we have been reading and discussion over the past few days. It is rather appalling that this will be verbally said. More focus is being pointed in the direction of the buyer than the artist who made it. “The right collector”-who is the right collector? Should there be anything like the right collector? Or is it a business term used at convincing the public that art deserves a rightful owner just because they have money to buy it? If there say all art is priceless, why are they so interested in the financial gains the works are going to bring them? According to Thornton, the consensus on a particular work of art or artist is that the super-rich buy art for social reasons. Taste, she argues, is determined by the vagaries of fashion; 'collecting art has increasingly become like buying clothes.

The financial interest in the auctioning has gone on for so long such that even if people are there to buy art for its sake, the purpose is not realized, because all you will hear are people in whose mind are thinking about how much the work will cost in the next 5 year and the social prestige they will gain from buying it. Having looked at a couple of auction video, I realized that the auctioneer does not utter a word about the content of the work, the meaning behind it and why it was made and for what purpose it was intended for. It is art for Christ’s sake not ordinaryauction sale.

Portrait of Adele Bloch-Baur II (the most expensive painting auctioned in the Christies NY)

Watch the video of the auction__________ http://www.youtube.com/watch?v=tUcCK74HIY0

A 1912 painting by Gustav Klimt, it depicts the wife of wealthy industrialist Ferdinand Bloch-Baur, an avid supporter of the arts and sponsor of Klimt. It was sold at Christie's in November 2006 reaching almost $88 million making it the most expensive painting auctioned in the Christies. The subject of the painting Adele Bloch-Baur is the only model to be painted twice by him.

Christie’s has added and perfected other services other than live auctions. Christie’s also engages in private client-to-client sales between customers outside of the auction room. In addition to this Christie’s has branched into real estate as well.

The rise of the Internet helped auction houses thrive in terms of accessibility. Many people, perhaps from foreign countries are now able to participate in European and North American auctions. Christie’s development and growth had a significant impact in parts of Asian and has contributed to the establishment of a viable art market there. During the late 80’s with the growing trend towards globalization many wealthy Japanese people became very interested in Impressionist art, specifically the works of Van Gogh and Monet. This booming international market caused prices to skyrocket. For example, in 1987 the Insurance company “Yasuda Fire & Marine Insurance Company” in Tokyo now known as “Sompo Japan Insurance” purchased Van Gogh’s Sunflower painting for $39.9 million US dollars. This Van Gogh was the most costly painting ever sold at auction. The sale more than tripled the previous record, which was $11.1 million US dollars, paid in 1986 for an Edouard Manet. The transaction shocked the entire art world. This period has come to be known as the Japanese Buyer Boom.

Van Gogh's Sunflowers (1889) purchased by Japanese Insurance Company in 1987.

Just judging from the 'then and now images' of a Christie’s auction I would guess that the original Christie's auction setting would have been quite chaotic and not quite as gentile. In 1810 Christie’s buyers would most likely have been art dealers themselves, looking to buy wholesale with significant retail mark up for their clients. This has changed significantly in the evolution of Christie’s because the new buyer tends to be the private collectors themselves and tends to be new money rather than establishment.

During the early years of auction houses buyers tended to be like a small, central, private clique, whereas today’s buyers come all around the world thanks to Christie's expansion in a catalogue business and globalization.

I do believe that in genreal the sellers have mostly stayed the same. In Christopher Mason’s book The Art of the Steal he refers to the auction house vendor as being precipitated by the three “D’s”: Death, Divorce and Debt. I think this statement was true at the commencement of Christie’s and still rings true today. However, todays sellers can also include museums wanting to de-asses certain works to raise funds or even private collectors wanting to “refurbish” their collections.

Another major changed that has occurred is the social status of the auction. In 1810 Christie’s auction floor looks frantic as the pushy buyers mirror cattle being herded. Today auctions have morphed into entertaining events where people go to be seen. Also, in the early stages of the art market selling a painting was seen with stigma. It was likely assumed that the selling of a painting only resulted in a need for quick cash. Today, many sellers plan to donate the earnings of a sale to philanthropic efforts. One example of this is when David Rockefeller sold his Mark Rothko painting in 2007 $72 million US dollars at a Sotheby’s contemporary art auction. Mr. Rockefeller had owned the painting for 47 years and stated that he would put the paintings proceeds towards charity. Mr. Rockefeller also had a private box to watch the auction from which shows how entertaining an auction could be. The Christie’s live auction has truly evolved since it’s inception and has ultimately become quite an integral part of not only the art market but the global economy.

David Rockefellar's Mark Rothko painting White Center (1957)

Purchased by Rockefeller for $8,500 or $59,000 in today's dollars and sold for $72 million US dollars in 2007.

The actors in the auction do not change from year to year, Thornton notes in her work that many sit in the same seats they had at last year’s auction. It is a small community where auctions are used for more than just buying and selling art, but catching up with friends and seeing rival bidders.

Ultimately, the auctions is less about the art than it is about verifying the current trend or showing the value of a certain brand. The recent Liz Taylor auction shows that auction houses can push prices sky-high by focusing on certain aspects of the art, instead of just the art itself.

Liz Taylor found the Hollywood spotlight in the 1944 movie, National Revolver. Just 12 years old at the time, her role in the movie led her career to achieve superstar status, taking her from child star to movie star. A recent Christies’ auction put up for bid a lilac leather-bound script which was used by Liz Taylor throughout the movie. The auction was expected to being in $2000-$3000, however the bidding went all the way up to $170,500. It is no mystery why the script was sold for so much higher than its expected value- and has everything to do with how the auctions are set up. Fantastically wealthy buyers are placed in a room, essentially competing with each other for a measure of wealth. The script is not the point of value in this sale. Instead, it is the fact that it belonged to Elizabeth Taylor, and further that it marks a certain sophistication and wealth of a buyer. Often auction houses will not sell a piece which has been sold on the primary market within the last two years. This is in order to gain the power of speculation. The works that auction houses sell are not only so that collectors can experience art, but so that they can say they have validated their preferences.

Consider & comment:

Please use this space to respond to your classmates' work and to engage in lively discussions on the day's topic. Keep your comments concise and conversational by responding to others, rebutting or supporting their ideas. Use the comment box below for these observations.