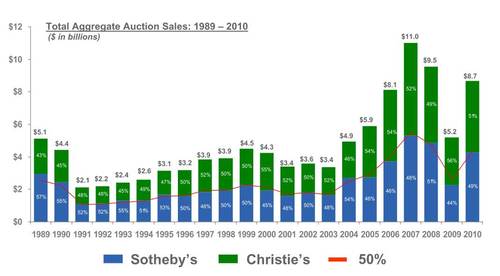

The popularity of Sotheby’s and Christie’s even after such a big conspiracy that resulted in civil and criminal (for Sotheby’s) settlements seems to indicate that the role of auction houses in the art world is one that is immense and essential. Although there was a decrease in total auction sales in the years immediately following the price-fixing scandal, both of the two auction houses survived. In fact, with the exception of the year 2009 when the major economic crash hit the nation, they’re doing more than okay (see graph). Bill Ruprecht, Sotheby’s president and CEO, revealed his confidence for the future auctions, believing that for the very rich, art collecting makes people feel “more confident with this group of works as a way for them to deploy significant capital” (Rosenbaum). That’s it- I think that as long as people see art as just another category in their investment portfolio, art auction will continue to be in demand.

http://www.artsjournal.com/culturegrrl/assets_c/2011/08/AuctMrkShr2-thumb-500x276-20343.jpg

The tactics of Sotheby’s and Christie’s to attract big sales by big sellers do not seem to have changed after the scandal. They continue to grant sellers guarantees (promised sums of money to be paid to sellers regardless of a sale’s outcome) and share of the premiums paid by buyers. With constant competition over the dominance in the art auction world, the rivalry between Sotheby’s and Christie’s doesn’t seem to ever end. According to one art market blog, the auction houses even wave their fees “in an effort to secure the sale of a particular artwork or collection just so they can get the resulting publicity and kudos” (Forrest).

Christie’s made a controversial purchase in 2007 of the gallery Haunch of Venison is another evidence of the rivalry that exists between the two auction houses. The purchase was criticized for causing a “conflict of interest” by “blurring the lines between what galleries and auction houses offer” (Forrest). Christie’s successful venture in purchasing a gallery would have proved that Christie’s could do what Sotheby’s couldn’t.

I also think that, the ostentatious and often pretentious behavior of the people who take part in auctions has its part in the success of the two auction houses. They delight in the appeal of the spectacle the auction houses offer, and it’s possible that their continued engagement in auctions have more to do with themselves, how important, how rich they want to feel and want to be viewed as, than it has to do with their confidence or trust in Sotheby’s or Christie’s.

If the art world were to rid of auction altogether, buyers as well as sellers would have to trouble themselves with slower and more cumbersome procedure to sell or buy art. Especially with auction houses now selling contemporary art by living artists, some contemporary artists will face more difficulties in raising their market value if the auction houses did not exist. Collectors would have to rely on secondary market to buy art, which can be troublesome because the galleries are selective as to whom they sell. Thus, the survival of the auction houses seem to be based on all actors’ needs and it is unlikely that auction houses will collapse beyond repair.

Works cited

Forrest, Nic. “Art Market Scandal: Sothebys vs Christies, In the red corner…” Art Market Blog with Nic Forrest. 22 Jun. 2007. Web. 12 Jan. 2012. <http://www.artmarketblog.com/2007/06/22/sothebys-vs-christies-in-the-red-corner/>.

Rosenbaum, Lee. “Market Share Reversal: Sotheby’s Edges Out Christie’s in First-Half Global Sales.” CultureGrrl. 3 Aug. 2011. Web. 12 Jan. 2012. <http://www.artsjournal.com/culturegrrl/2011/08/sothebys_edges_out_christies_i.html>.