Former Sotheby's chairman Al Taubman and former Guinness PLC chairman Anthony Tennant.

(Photo: From left, Neil Rasmus/Patrick McMullan; Alastair Grant/AP Photo)

DAY 11 Today is Friday, January 13,th and we will probe deeper into the relationship between auctions and the art market through the case of

the Sotheby's price-fixing scandal, which shocked every corner of the art world from 2000 to 2002, when the case was finally settled. Read about

how Sotheby's, led by Chairman Al Taubman and CEO Dede Brooks, colluded with retired former chairman of Christie's, Sir Anthony Tennant, to

fix commission rates charged to buyers and sellers who did business with their respective auction houses. Both firms were charged by U.S.Justice

Department with breaking the Sherman Anti-trust Act of 1890, which was hugely important for safeguarding against under-the-table agreements to

set prices at levels that would not prevail in a competitive market and thusly, preventing monopolies that would hurt consumers by overcharging them

while reaping high profits and slowing production. Comment on at least two ways in which this scandal has (or has not) changed the perception

of the auction house as a necessary and essential place to do business in the art world. In other words, could the art world do without the auction

house and if so, what might that look like?

Readings

Listen to author Christopher Mason explain how he began covering the price-fixing conspiracy http://video.cnbc.com/gallery/?video=697473416;

hear Alfred Taubman's thoughts on his meetings with Sir Anthony Tennant http://video.cnbc.com/gallery/?video=697487072; and see some of

the handwritten notes detailing the terms of the "fix" http://www.cnbc.com/id/23812895/ from CNBC's American Greed, Season 2, Episode 16,

"Soaking the Rich at Auction".

Read Orley Ashenfelter and Kathryn Graddy,"Anatomy of the Rise and Fall of a Price-Fixing Conspiracy: Auctions at Sotheby's and Christie's,"

Journal of Competition Law and Economics I (I) 3-20, 2005 http://www.econ.ucsb.edu/~tedb/Courses/Ec1F07/ashenfeltersothebychristie.pdf

and James B. Stewart's, "Bidding War: How an Antitrust Investigation into Christie's and Sotheby's Became a Race to See Who Could Betray

Whom," the New Yorker, Anals of Law, October 15, 2001, p. 158 https://www.msu.edu/course/ec/360/george/Readings/Bidding%20War.htm

Individual Contributions

The art auction process, while seemingly immoral and useless, does actually add a very valuable characteristic to the art market, which is an indicator of liquidity. The auction process creates market value for artists, brings together buyers and sellers, and sets market prices in the most efficient way possible. In the ideal world, there would be many different auction houses, more varied than simply Sotheby's and Christie's, which would add competitive value to the marketplace and help arrive and efficient prices and indicators of value, and so the best consequence of the price-fixing scandal is the economic necessity for other competitors, who advertise their impartiality and objectiveness in determining prices, to enter the market--only with the maximum number of intermediaries can the art market truly function efficiently with the greatest store of value and allocation of resources. If anything, the scandal has positive repercussions for the art market, as it strongly incentivizes increase transparency, accountability, and objective analysis in the market as a whole and in the eyes of the ultimate consumer.

It seems to me that despite the incredible abuse of clients and employee relations in the price-fixing scandal of Sotheby's and Christie's, both auction houses continue to thrive in an economy where culture and social status can go to the highest bidder. The continuation of their legacy after such a political affront appears to be due to an economic tone of the times which equates the sale of art to money and values art by how much it can sell for. In earlier times when thoughts about the value of work were less about making an investment, this kind of scandal would have put both houses into disrepute by their main clientele, the wealthy and prideful. But current times seem more over run by a new kind of buyer, the wealthy and savvy. These new investors have less concern about saving face and more concern about making the most of their investments.

Additionally, if the auction houses, as they exist today, were to go out of business, that would mean bad news for many of the investors who have bought and especially for those who have sold on this market. Other venues for selling art are less democratic, or capitalistic in a sense, because dealers, galleries, and even trading collectors all rely on the symbolic and cultural value of their art (which they give it by NOT selling it). Many of the people who buy at auction on the secondary market, would not be able to make successful purchases on the primary market or even the secondary market run by primary market galleries. Gallery owners and dealers often will sell a work at a lower price into a better collection or institution instead of taking the high price and risking that the work be resold quickly (and devalued culturally).

In a world without auction houses, the idea of art as investment would be less stable and less publicly displayed. It would therefore be a less desirable draw and the infrastructure supporting the market at such record high levels would collapse. The art market, I would say, would return to a more discreet and eccentric group of buyers and aristocrats. The art auction houses add an element of certainty to the prices of works of great art and allow for the valuation of works to come. This is partially though practices of buying in art to prevent it from going unsold at an auction and from the establishment of secret reserve prices set by sellers who wish to insure the value of their art is retained. However, even if the formal auction houses were to collapse, there is reason to believe that they would simply be replaced by an underground alternative. Even before prosecuting the auction houses, the Justice Department was investigating the occurrence of "ring" bidding, were dealers agree not to bid against each other to acquire a work cheap from auction, and then hold a second, secret auction for only dealers.

http://www.artinfo.com/news/story/24595/taubman-memoir-offers-take-on-sothebys-scandal

http://nymag.com/arts/art/features/30620/

http://www.time.com/time/magazine/article/0,9171,996261-2,00.html

The reputation of the actual auction house itself was tarnished yet this also did not seem to lead to any negative impact on Christie’s. After the scandal, the first major auction held in May 2000 was still able to get good prices for the works of art sold that day. It was documented that a surrealist and modern art assembled piece by Rene Gaffe, a Belgian mogul, sold for $73.3 million, almost twice it’s estimated value2. Even Sotheby’s was able to sell successfully after the scandal. Sotheby’s was able to obtain record prices after the sale of Impressionist and modern art that was sold in a New York sale. Because of this, nothing much has changed about the auction house. It is remarkable that the players involved can commit crimes, and seemingly get away with punishments that don’t seem worthy for the crimes they committed. It seems as though the scandal shows that the auction is still necessary. Despite all the negativity associated with breaking the law, people still returned to the auction, still sold and bought pieces, so clearly there is a need for the auction. People still use and benefit from its existence so I think it will be around for some time.

I believe that the art market could do without the auction, however the sales process of art would likely be much slower, and possibly less organized. One of the advantages of the auction is that it allows one to avoid the time-consuming politicking expected by primary dealers, who, in the interests of building their artists’ careers, try to sell only to collectors who have the right reputation. Artists too would likely have a difficult time selling their pieces3. Many artists claim that selling their pieces can be a depressing activity. Because they are associated a monetary value with their pieces the process is comparable to selling one of their children. Essentially it is a difficult process that is avoided via auctions. So with auctions, sales seem much more straightforward and emotionless. Without the auction, it is likely that selling are would become more tedious, time-consuming, and emotionally draining.

References:

- Ashenfelter O, Graddy K: Anatomy of the Rise and fall of a Price Fixing Conspiracy: Auctions at Sotheby’s and Christie’s. Journal f Competition Law and Economics, 1:3-20, 2005.

- http://www.icmrindia.org/casestudies/catalogue/Business%20Ethics/Business%20Ethics%20-%20Ethical%20Issues%20at%20Christie.htm

- Thornton, Sarah. Seven Days in the Art World. New York: W.W. Norton, 2008. Print.

Today’s readings about the price fixing scandal reinforce Thompson’s point in his book that the “art trade is the least transparent and least regulated major commercial activity in the world” (Thompson 29). So I guess it’s not surprising that the auction houses were involved in illegal activity. While it harmed the buyers, the sellers, and the integrity of the auction houses, I don’t think it had a long-lasting or even a significant impact on the art market.

The auction house is a key part of marketing for the whole art world – not just for the auction houses, but for the galleries and everyone else involved. I don’t think the scandal, as bad as it was, changed the perception of the auction house as being essential. I say this for two reasons.

Confidence: First, a perception of confidence must still exist because the fact is that both of the auction houses involved in the scandal are still in business and making a lot of money. Sotheby’s stock trades at $32 a share and has a market value of $ 2.2 billion. http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=BID:US

Christie’s had sales of $3.2 billion in the first half of 2011. Here is a link to their press release:

http://www.christies.com/about/press-center/releases/pressrelease.aspx?pressreleaseid=4940

The continued confidence in the auction house may have initially been the product of the civil settlement they paid. But in the long run I think it had more to do with the fact that both the buyers and the sellers want the auction house system to remain in tact. So even if the art market could live without the auction house, I don’t think anyone involved wants to do away with it.

Auction houses still do business as usual: Christy’s did not fire high ranking executives who had knowledge of the price-fixing. Instead, many of them were promoted and some received multi-million dollar bonuses (Stewart 15).

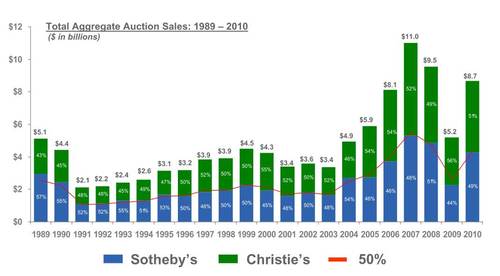

For 2 – 3 years after the scandal broke, Sotheby’s stock value dropped a lot and was only worth a few dollars a share. But aside from the drop again during the middle of the recession in 2009, the stock is now worth almost as much as before the scandal. To me, this means that the auction houses easily handled the problem and probably looked at it like a cost of doing business. Also, it shows that there is no perception that the market can do without the auction house. To the contrary, and even if its not essential, the people involved in the art market want and need the auction houses to continue growing business. If the perception was that the market could do without them, they probably would have closed down after the scandal.

Here is a graph of the history of the stock price for Sotheby’s, which uses the symbol BID.

My opinion is that without the auction house, the art market would not be as successful as it is today. Anyone agree?

The perception of the art auction system has been almost entirely informed by the two-party relationship between Christie’s and Sotheby’s from their creation. Had Christie’s managed to eliminate Sotheby’s and essentially create a monopoly, the consequences may have changed the position of the auction house in the art world by eliminating the already scarce competition and driving up prices even more. Through negotiations and cooperation with the lawyers handling the civil suit for Christie’s and Taubman paying a substantial portion of the settlement, Sotheby’s managed to survive.

As concluded in the paper by Ashenfelter and Graddy, the price-fixing had minimal repercussions for buyers and so the demand by buyers on the market was not significantly affected. If buyers had been seriously injured I think there may have been an outcry that could have damaged the auction houses. While the sellers were injured as well as the individual players at the top (Tennant, Taubman, Davidge, and Brooks), the auction houses themselves managed to maintain their reputations as a whole.

I think that it is possible for the art market to continue doing business without the auction house but I do not think it would manage as effectively (or lucratively). Buyers and dealers would have to put much more of an individual effort into finding the art that they wanted or patrons to sell works to. The auction system is very convenient for most of the parties involved and keeps the art market moving at a swift pace. It would not be in the interest of these parties for the auction houses to disappear, and I believe this is a significant reason for the houses coming out of the scandal relatively unscathed.

I think that all the discussion of antitrust law is ironic when the power held by these two auction houses really amounts to a monopoly to begin with. As they are, I do not know that Sotheby’s and Christie’s would meet the criteria of open competition as defined by the Sherman Antitrust Act. For example, antitrust law was used recently (and successfully) to block AT&T from acquiring T-Mobile in what would result in the narrowing of the cellphone market to three main providers which would decrease competition. If this is the case for the cellphone market (as well as many others), how can it be that only two auction houses are allowed to influence/control the art market unchecked?

http://www.artsjournal.com/culturegrrl/assets_c/2011/08/AuctMrkShr2-thumb-500x276-20343.jpg

The tactics of Sotheby’s and Christie’s to attract big sales by big sellers do not seem to have changed after the scandal. They continue to grant sellers guarantees (promised sums of money to be paid to sellers regardless of a sale’s outcome) and share of the premiums paid by buyers. With constant competition over the dominance in the art auction world, the rivalry between Sotheby’s and Christie’s doesn’t seem to ever end. According to one art market blog, the auction houses even wave their fees “in an effort to secure the sale of a particular artwork or collection just so they can get the resulting publicity and kudos” (Forrest).

Christie’s made a controversial purchase in 2007 of the gallery Haunch of Venison is another evidence of the rivalry that exists between the two auction houses. The purchase was criticized for causing a “conflict of interest” by “blurring the lines between what galleries and auction houses offer” (Forrest). Christie’s successful venture in purchasing a gallery would have proved that Christie’s could do what Sotheby’s couldn’t.

I also think that, the ostentatious and often pretentious behavior of the people who take part in auctions has its part in the success of the two auction houses. They delight in the appeal of the spectacle the auction houses offer, and it’s possible that their continued engagement in auctions have more to do with themselves, how important, how rich they want to feel and want to be viewed as, than it has to do with their confidence or trust in Sotheby’s or Christie’s.

If the art world were to rid of auction altogether, buyers as well as sellers would have to trouble themselves with slower and more cumbersome procedure to sell or buy art. Especially with auction houses now selling contemporary art by living artists, some contemporary artists will face more difficulties in raising their market value if the auction houses did not exist. Collectors would have to rely on secondary market to buy art, which can be troublesome because the galleries are selective as to whom they sell. Thus, the survival of the auction houses seem to be based on all actors’ needs and it is unlikely that auction houses will collapse beyond repair.

Works cited

Forrest, Nic. “Art Market Scandal: Sothebys vs Christies, In the red corner…” Art Market Blog with Nic Forrest. 22 Jun. 2007. Web. 12 Jan. 2012. <http://www.artmarketblog.com/2007/06/22/sothebys-vs-christies-in-the-red-corner/>.

Rosenbaum, Lee. “Market Share Reversal: Sotheby’s Edges Out Christie’s in First-Half Global Sales.” CultureGrrl. 3 Aug. 2011. Web. 12 Jan. 2012. <http://www.artsjournal.com/culturegrrl/2011/08/sothebys_edges_out_christies_i.html>.

It seems that Christie's and Sotheby's together offer something that no other art market institution can. They are the barometer for the value of secondary market artworks. Auction sales make blockbuster headlines, wealthy collectors are able to compete over highly desired works, and the rest of the art community looks to these auctions as a means to gauge the market. This is in part because Christie's and Sotheby's have dominance over the secondary art market. It would be difficult for the art world to find a reliable indicator if these major sales were done by many smaller auction houses or individual galleries. Buyers can be reassured when they buy from these houses. As Thornton notes in her article from our last class, “All art is priceless, but assurance is expensive” (13). So in this way I think that the price-fixing scandal has not really changed public perception of the auction house, as it will remain a barometer for the secondary art market that most people rely on.

Despite the fact that buyers took most of the loss in connection with the price-fixing scandal, the Ashenfelter & Graddy article points out that, “it is unlikely that successful buyers as a group were injured” (3). So it appears that the major consequence of the scandal may perhaps motivate buyers to be even more competitive. Buyers already know that they are in competition with everyone else at the auction, and that its main goal is to make as much profit off of them as it can. Even the auction houses estimates do not reflect or influence how much buyers are willing to spend. A recent article in the LA Times is titled, “Christie's: Elizabeth Taylor $137-Million Auction Makes History.” A representative of the auction house told the paper, “It was the most valuable jewelry sale in auction history.”

http://latimesblogs.latimes.com/gossip/2011/12/elizabeth-taylor-kim-kardashian-jewelry.html

With sales like this, I would say that the auction houses have not lost buyer confidence, and Christie's and Sotheby's are likely to keep their institutionalized status.

Bibliography:

Thornton, Sarah. Seven Days in the Art World.

https://www.msu.edu/course/ec/360/george/Readings/Bidding%20War.htm

Sotheby's and Christie's are two of the largest and most well-known auction houses in the world, and in the mid 90's neither were making enough money from sellers' commissions to keep their large art empires afloat, therefore they decided to enter a price-fixing pact, whereby each auction house would offer the same commission rate. FBI Investigations of the auction practices revealed that the two companies were in collusion. Both of the CEOs Diana Brooks, and Alfred Taubman were found guilty and were forced to step down from their positions. Taubman spend ten months in jail, and Brooks spent six months in home confinement. Both were charged a monetary penalty, and both auction houses were required to pay a total of about half a billion dollars together, to make up for the money taken from sellers.

One would think that after this huge conspiracy, people would be less inclined to use the auction houses to sell and purchase their art, and thus the companies would suffer, but this was not the case. In fact, the art market was not affected, both auction houses continued to prosper. The only people affected by this price-fixing, were the CEOs themselves, and the auction houses, but only in that they had to pay back the money that they had illegally received. It would make sense if people had lost their ability to trust the auction houses, and thus chose to sell their art pieces elsewhere, however this also was not the case.

I believe that people expect a certain percent of corruption from large businesses like these auction houses, and thus were willing to overlook this injustice because it was not surprising. Not only that, but I also believe that in the minds of some large art consumers, the idea of buying a piece at a world famous auction house increases the worth of the piece itself, and they would not trust the authenticity or worth of a piece of art were it not sold by one of these large auctions. This, coupled with the idea of an open auction where you are bidding against other avid art fans, provides the incentive to spend more money on a piece, and thus art auction houses have not been hurt by these charges of participating in illegalities.

Sotheby's and Christie's are also not alone in their corruption of selling art, many other world famous art auctions have followed suit and in 2010 France's most profitable auction site was also exposed, but for a different corruption. They had been housing an extensive art-trafficking ring. You can read more about this here:

http://www.nytimes.com/2010/04/27/world/europe/27paris.html

Although the art auction house is, by nature, a corrupt place, where the companies only care about themselves, and their profit, many people believe it is necessary to the art market, and I somewhat agree. It is necessary right now, because art enthusiasts regard it as the premiere place to purchase and sell art, thus it is believed that it gives the art bought and sold there, a higher quality, and thus a higher value. Eventually it would be wise, and doable to rid the art market of these auctions, however there would need to be another place to purchase and sell art with the same allure and prestige to take its place.

Price-fixing violates the principles of a fee market economy. The social benefits from price fixing are thought to be small or nonexistent. The conspiracies involved in price fixing are unstable and unlikely to be effective in maintaining artificially high prices. Christie’s was a privately held company while Sotheby was public and this might have led to price fixing activities, because it was not only sued by the costumers but also by the shareholders. The fact that Christie’s was a privately held company meant that the large fine clearly affected the value of the company and its major shareholders. As people became used to buying art for high prices, these companies decided to make money off their clients and take advantage of them. In so doing they made an agreement that the more a painting sold for, the more commission the house will receive in so doing they both shared the information of their clients including their salaries. With this information they could carefully examine their bidders with attention and in detail. Auction houses appear to conduct auctions in a manner that suggests that art buyers are unable to make decisions for themselves when buying at auction, and need to be told what they should be buying.

With this said, could the art world do without the auction house? I hope they will because they can, but it doesn’t look like that is what is happening. It is reported that Sotheby's made a profit of $96.2m, or $1.38 a share, up from $73.6m, or $1.09 a share, a year earlier. I don’t think that art buyers and collectors have decided to forfeit the idea of auction houses, go through all the hustle and tussle to make new choices in finding out the best way to buy their art. They have become so accustomed to the tradition of auction house art buying that they have nowhere to go-so to say. The auction houses are also not ready to forgo their business and are trying every tactics to keep the art world under their belt. Here is the case where auction houses are now on the Internet making their money from the art buyers. Where else will the art world to buy art? The Gallery? The galleries are no different when it comes the quest for making money. I think that the art world, buyers and collectors have acquainted themselves with the structure and fanciness with which the auction houses have presented to them that they are in love with it. Actually I should say that in the last two years, auction prices have skyrocketed and buyers are eager to bid as much as they can to get it. These people are all part of the game; they together with the auction houses control the art world.

Now if we want to do away without the auction houses, we certainly can. We will have to build and trigger the confidence and trust within our selves, where by the young sought-after artist begin to work together without expecting a market mechanism to be looking out for them and managing their careers. The bait of financial gain and international recognition can be intoxicating and should not be part of the new move if we really want to do away with the auction house.

In 2000 Christie's ratted on Sotheby's by providing "information relevant" to the Justice Department, just weeks after Christie's chief executive, Christopher Davidge, hastily resigned. Davidge was followed by the two top officials of Sotheby's, A. Alfred Taubman, the chairman and largest individual stockholder who bought the firm in 1983 and took it public in 1988, and DeDe Brooks, its chief executive. The scandal unwrapped that Sotheby’s and Christie’s had been in cahoots to fix commission prices.

Auction houses charge two commissions on sales--one from the buyer, the other from the seller. It's perfectly legal to drop or raise prices after a rival does; gas stations facing off across an intersection do it all the time. What's illegal is for two or more rivals to form an alliance by agreeing in advance to fix a price. One of the signs that this was happening was a pattern of changes in the commission between Sotheby's and Christie's. In 1992 Sotheby's raised its buyer's fee from 10% to 15% on the first $50,000 (on higher amounts the buyer paid 10%). After just seven weeks, Christie's announced an identical fee rate. Three years later, Christie's took the lead by changing its seller's fee from 10% to a sliding scale of 2% to 20%. After a few weeks, Sotheby's did the same thing.

I don’t believe the long-term effects of the scandal have changed the perception of the auction house. Despite the broadcasted series of events, the investment and participation in the auction houses has not significantly declined. Shortly after the scandal Christie's announced a new fee structure, raising the amount buyers must pay to 17.5% on the first $80,000 and 10% above that but reducing the seller's commission for customers who buy a lot of art. Sotheby’s took longer to announce changes but reshaped itself into a monopoly. The major affect of the scandal was that dealers hoped that clients would buy more through them and less at auction. Although dealers sold the idea of a relationship with someone you know and can trust, there was still much appeal to the importance of live auctions. Although Sotheby’s almost went bankrupt buyers were not very hindered.

As Ashenfelter and Graddy concluded, the price-fixing had minimal affect on buyers and so buyers were not hindered to continue to buy through the auction houses. Because the auction system provides incredible artwork that sometimes galleries cannot, there is still a market for the auction houses. I also there is more comfort in buying through an auction house as it is an established company, rather than a private gallery that seems less legitimate.

The interesting part of the scandal is that before the price fixing, the rates were not done in an appropriate way either. Auction houses would essentially bid for business themselves by appealing to the seller, often donating to a possible seller’s charity to win business.

Despite the scandal, many aspects of the auction system remained the same.

One would expect that after the price fixing scandal, collectors and sellers would feel betrayed. The high-end art buying community is relatively small, and a backlash in confidence could drastically affect business. However the scandal did little to bring down business. In 2010, Christies sales totaled over 3.3 billion British Pounds. The auction houses had little effect on the confidence in their business. In fact, in 2007 the auction houses expanded into the primary market, acquiring private galleries.

The buyer’s premium which is a fixed percentage of the auction price to be tacked on to the sale is not only here to stay after the scandal, but is being expanded upon. There is a currently a bill proposed in Congress which would set a percentage buyer’s premium charge to be dispersed from secondary market sales to the original artist (if living).

My question to the class is how do you force fair rates in a two competitor system? There is such prestige at being sold at one of these auction houses that an emerging auction house might not even have a chance to compete.

Consider & comment:

Please use this space to respond to your classmates' work and to engage in lively discussions on the day's topic. Keep your comments concise and conversational by responding to others, rebutting or supporting their ideas. Use the comment box below for these observations.

15 Comments

user-c6d08

Do you agree with the punishments each of players involved received? If not, what do you think should have been the punishments and how do you think people can go about preventing such a scandal from occurring?

user-9c486

It seems like the punishments were fair, especially the money that had to be paid. But they may have just considered it a cost of doing business and getting caught. The auction houses definitely survived the scandal.

What I find very interesting is that the auction houses are so resilient, so much so, that Christie's even survived selling a fake Basquiat!

If that was not enough for the art market people to stop using them, nothing is.

Here is the link to an article about the fake Basquiat: http://www.artlyst.com/articles/test-case-challenge-over-fake-jeanmichel-basquiat-to-limit-auction-houses-liability

user-c6d08

wow! fake Basquiat. Now, I definitely didn't know they could get away with that!

user-9c486

I agree with you Dalanda. I don’t know if they got away with it completely because of the lawsuit that was involved with that. But what I find amazing is that the auction houses are able to overcome big problems – whether it be commission fixing or selling a fake painting. I think it’s because the perception in the art world is that, no matter what, the auctions help promote the art market in a way that nothing else can.

user-9caf1

Dalanda, I'm not sure how I feel about the punishments... It seems in reading about where all the major players are a few years after the scandal that they each got off pretty easy considering they tried to defraud hundreds of people out of millions of dollars. Taubman went to jail, and Brooks was sentenced to house arrest, but each only for a number of months and then went on to resume their happy, rich, art filled lives. In fact, Davidge being able to receive 5 million dollars in a severance package dependent on his cooperation in the case is outright hilarious if you ask me. He was being paid to spill the beans, get his company off scott free in the criminal trials, and did not himself bear any of the costs of the civil suit.

I think harsher punishments could have been an answer as to how to keep such scandals from occurring. These types of collusions usually come out to the public in due time, but making an example out of Sotheby's and Christie's might have shown that not even powerful companies that people think are untouchable are immune from justice.

user-1a787

I agree with Christina. I can't believe that golden hamster not only got away with the crime he committed but also received all of the $5 million severance! I also don't understand the whole amnesty deal. It just seems so unfair.

user-e58b5

user-e58b5

I don't really know what should be done to prevent such a scandal from happening again. It seems that those who should be most upset with the auction houses-the buyers-are supporting them by continuing to go to the auctions.

The auction houses are so integral to the market in terms of publicity and buyers assurance that without them I think that the secondary market has no center.

user-11970

Kelly, you know, that is the thing about power and money, the auction houses are getting their money, the buyers and collectors are getting their fame, prestige and power. The have been coerced into the system so much so that, they cant just leave. They have become addicted to it. If you look at the difference between christie's in 1810 and the 2008 christie's images from yesterday, you can imagine the improvement that has gone into these now power houses and it is fair to say that I understand where these art buyers are coming from. We shouldn't also forget that most of these people might not necessarily be art lovers, they are mostly rich people who are taking advantage of what is readily available to them to get what they want. After all, are they going to go to "boring galleries" to mix with ordinary people like us to buy their art? I don't really think so, so then they clinch to what they have known for over 200 years, "the auction house"- and the auction houses know that they have no where to go too.

user-1a787

I agree with you that the buyers at these auctions largely participate for the cachet of the event. To them auction is like a sports game. And I think it was the Thornton reading that said that they equate buying to "winning." This sense of victory must be addicting. Not only can they say "I have a Warhol" but also "I, not this guy or that guy, won it." Isn't that why some collectors send others to bid or bid through phone, because they don't want to face the public embarrassment at "losing?" And yes, I don't think these people would want to buy art directly from galleries in the backrooms because that's just not public and ostentatious enough.

Whether economic or social, all actors in the auction game have their reasons, they know what they want, to come back to the auction room. Also because the sellers and the buyers want different things (sellers want money and buyers want prestige), even such big scandals like the price-fixing conspiracy doesn't do much harm to the system.

user-9caf1

June, I totally agree with you on the spectacle of the sport. The guy you're thinking of is Charles Saatchi. He used to call in phone bids so that no one would be the wiser if he was out played, but he could play up a big win in the papers the next day by announcing it to the press if he so wished. Smart man.

user-9caf1

Hey guys, so in some more research about how the scandals were covered in the press, I came across an article that said the following:

The feds' investigation did not, in fact, begin with the auctioneers. In the early 1990s, the Justice Department turned its scrutiny on private dealers in an effort to nail the ones who indulged in "ring" bidding-the technique of defrauding sellers by agreeing not to bid against one another in the auction room so that the low balled object could then be sold by the ring at a second, informal auction of dealers only. About a dozen dealers and collectors were convicted. But Justice decided hat the paper trail compiled in those cases might lead further to Sotheby's and Christie's. It subpoenaed truckloads of letters, documents, phone books and sales catalogs from both houses, and started to dig.

What do you guys think about the fact that the auction houses aren't the only ones holding auctions? Do you think this action by the dealers is as despicable as the scandal by the auction houses? Why do you think it has received so much less press coverage?

user-1a787

That's so interesting! I had no idea that private dealers also did that.. This "ring bidding" technique, too, is an illegal collusion that violates the Sherman Antitrust Act, and I think it's equally wrong as the auction houses' price-fixing scandal. The reason these things do not get as much press coverage as the auction houses is because the former is committed by a group of individual dealers as opposed to the two biggest auction houses worldwide. I would say that the art business is pretty specialized and precisely because it's not the most mainstream sphere of trade, illicit activities by a small group of art dealers may not be of great interest to the mass. The auction houses, while they are also associated with the art world, are big, powerful institutions, whose punishments and disintegration people just love to hear. A collusion among the dealers cheats the auction house out of the profit it wishes to make. A collusion among the auction houses overcharges the dealers. Which side would disgust an average person more? Probably the auction houses.

user-fd7c0

Both situations (fraud by auction houses of dealers) are equally disgusting yet unsurprising. This all reminds me so much of what goes on with the stock market and Wall Street with the manipulation of prices, insider trading etc. Its pretty much the same crowd involved in both markets anyway.

I did find it unfair that Tennant and Davidge escaped any major punishment while Taubman and especially Brooks were harshly punished because of the different antitrust laws in the UK and U.S. I have to say though that I don't have much sympathy for any of the parties involved. These are people and institutions with so much money and power that they seem to think they can get away with anything and they pretty much do. I don't think the case had any major long-term damaging effect on anyone involved except possibly Ms. Brooks although I wouldn't be surprised to discover that she recovered quickly from the debacle as well.

Cheryl Finley

Hi all -- you're responses to the price fixing scandal and its effect on the art market, the auction houses and their clients indicate that little has changed since this scandal. It is perhaps no surprise that the parties held accountable escaped with little penalty and the huge leap in the stock holdings of these companies -- Christies and Sotheby's -- and their larger global reach since this scandal and its settlement suggest to me that much was more was gained by the auction houses, perhaps, as a result of the scandal. That is to say, that they devised a new way of working, they rebranded themselves to be powerhouse dealers in the art world, selling more contemporary art and first time new artists than ever before.