Christopher Burge, auctioneer at Damien Hirst Sale, Christie's, London, 2008.

DAY 17 Today is Thursday, January 19th, and we'll take an in depth look at Damien Hirst's "Beautiful Inside My Head Forever"

auction at Sotheby's, London just as the global financial crisis began to surface at the end of September 2008. Look

at the short Time magazine interview with Hirst as he prepares for the auction and read one of the auction reports.

Knowing now what you do about auctions, Hirst, and the commissioning process, discuss the pros and cons of the

Hirst auction for the art market as a whole and for Hirst as an individual artist/entrepreneur. Since this sale (and the

global financial crisis), Hirst has been losing market share and many of his works frequently don't find buyers at auction.

Do you think he's over-produced or overexposed himself? You can use other high profile auctions or examples of

artist/entrepreneurs in your response. Note: the Art Market Monitor article lists a number of useful articles, graphs and sites.

Readings

Damien Hirst: Bad Boy Makes Good http://www.time.com/time/magazine/article/0,9171,1838681-2,00.html

Review: Artlaw, Auctions: Beautiful Inside My Head Forever http://www.artquest.org.uk/artlaw/money/auctions/beautiful-inside-my-head-forever.htm

Art Market Monitor: Beautiful Inside My Head ... Whatever http://www.artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/

Damien Hirst: Rich Artist Gets Richer http://www.time.com/time/video/player/0,32068,1774353335_1839008,00.html

Individual Contributions

Of course, if one's livelihood depends on brand name an public perception, it is vital that this perception be effectively managed. While Hirst has succeeded in doing so for much of his career, it seems that he has overextended himself, and is at risk of losing considerable reputation capital and prestige. The Beautiful Inside My Head Forever auction was another attempt by Hirst at redefining the art marketplace, just as his contemporary art has done over the last decade. Hirst effectively circumvented the dealers for the first time. Instead of subjecting himself to the sizable cut dealers normally take, he sold over 200 original works at auction, bringing fresh artwork directly to the public market in an unprecedented move. Only several artists have the international clout and standing to get away with this and support an entire auction on reputation alone. Hirst is the classic market-based artist; while in general dealers are praised for their ability to maintain the integrity of art, which they do by selling to buyers only selectively, after ensuring that the buyers are not profit-driven and will donate to museums and increase the prestige of the artists, Hirst has embraced the fact that he is a producer of art as a commodity. He is trying to bridge the gap between producer and consumer, cutting out the middleman, and modernizing the art market into a truly competitive, transparent landscape. This is an important step towards fully converting art into a market commodity, and is not without its critics.

However, in my view, the art market cannot function with this perspective. Even though most of the demand is artificial and is based on buyer perception, art still retains the majority of its value through its inherent scarcity and uniqueness, and the skill that was required in its production. By definition, art cannot be easily copied or replaced without losing value. Because it does not produce cash flows or provide economic or practical benefit to its owner, the aesthetic quality and differentiation between each piece is of paramount importance. It cannot be mass-produced without sacrificing demand. Hirst's model has always been at risk of devaluation, as he employs an army of assistants in producing work that fills only five categories. He got away with it by not mass-producing his art and riding on the prestige garnered from several noteworthy pieces early in his career. The auction noted above, while bold and cutting-edge, effectively unraveled most of Hirst's early success; he mass-produced items that were at great risk of being mass-produced. His works were not distinct enough to survive their oversupply, and while Hirst had brand-capital previously unseen in the art world, he failed to understand one of the basic tenets of economics: when supply skyrockets, each individual unit, by definition, becomes less valuable. Operating in the Hirst model of mass-production and limited differentiation, this can be a death sentence. As theory proves, Hirst has seen his prices fall drastically since the auction, as outlined by several graphs highlight below. By his own admission, Hirst created the four seminal pieces described above, and the rest is just "puff." Hirst will always be famous, even after his death, for what he represented and the change he brought about the marketplace, but unless he creates new masterpieces or drastically changes his style of production or the mediums he works with, his greatest successes might be behind him.

An interesting parallel to consider is the comparison between Damien Hirst and his own Golden Calf: Hirst is the king of the art world, glorified and worshiped by the crowds, but without any real substance.

Sources:

http://www.time.com/time/magazine/article/0,9171,1838750-3,00.html

http://www.time.com/time/video/player/0,32068,1774353335_1839008,00.html

http://artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/

Graphs highlighting the declining performance of Hirst's artwork (for space considerations)

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.11.35-AM1.png

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.10.57-AM11.png

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.11.15-AM1.png

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.10.24-AM1.png

Cons for the Art Market: In selling these works on the primary market through auction houses, Damien Hirst was trying to establish a precedent that he has been hoping would become the new norm in the art market, namely that a piece of artwork would sell for the its highest price in its first sale. Undoubtably, Hirst holds this opinion because as an artist he sees a cut of the first sale and then no other profits on the secondary market. It seems unfair that art should appreciate in later transactions and the artists creating the work should not benefit from this. Yet this is an unhealthy precedent to set for a market revolving around growth and the projection of increased market profits. If art will only depreciate with each sale, who would ever buy it or sell it again? It might potentially be beneficial for arts in the sense that it would mean people buying work were interested in its more intangible aspects. Unfortunately, it is a very bad thing for this to be the way of things for the art market as an economic entity. And the reality of this is setting in. In the months following his auction, nearly 2/3rds of his works went back up at auction and sold for less than they had originally been purchased for.

Further, in selling his work in the auction houses as a primary market, Damien Hirst sets up the possibility for other artists to follow in his footsteps and disrupt the artist/gallery relationship. By bypassing his galleries, Hirst has made more significant profits for himself, but the art gallery is not to be dismissed as unimportant to his career. The galleries and the placement of his works into museums and important collections has no doubt played an important role in his fame and fortune. If other artists of wealth and status follow suit, then they could potentially discredit their galleries and destroy a vital element in the life of the emerging artist. We can only hope that this process will go in the other direction and that some famous artists' departures will cause a fresh influx of new art into galleries, breathing new life into them and attracting a new clientele of investors.

Pros for Damien: Pros for Damien clearly stand in the realm of sheer profits he has made by the sales. With record direct income, and not having to split the sales prices with a dealer, Mr. Hirst has been able to raise a significant amount of money in a short time. Also, if the rumors are true, he has been able to rid himself of excess inventory so that he can start his artistic endeavors anew. Finally, the media coverage of this milestone auction has increased Damien's branding and fame as a heavy weight artist on the scene.

Cons for Damien: Cons for Damien seem to be more on the side of his declining current prices and a flooding of the art market. While Damien's auction was well timed and right before the big bubble burst in September, the declining prices of his work in the following months has severely damaged his image on the art market. Many of his paintings, specifically his butterfly paintings, went right back on the market following the bubble burst for lower prices than they had fetched originally. This brings uncertainty as to the worth of Hirst's oeuvre. His future work could be worth less because of this sharp fall in his current prices and the confidence he has lost from his collectors. Also problematic is the fact that Hirst essentially flooded the market with his goods to a slew of new dealers and collectors (whoever was willing to pay, and not people of good repute for holding onto works or lending them prestige). These newcomers then put many of his works back on the market immediately. The huge amount of Hirst work currently available on the secondary market is unprecedented and definitely contributing to his falling prices. I think it was a mistake of his to flood the market and overproduce in such a public way. His gallery is said to have hundreds of his works in back stock, which are rumored to be works they couldn't sell, but I think that this could have been a strategic maneuver to limit works available and increase exclusivity to drive up prices. Damien has thus undone all of that work in one fell swoop... and he's lucky he saw some big profits now because he might not in the near future.

http://www.modernedition.com/art-articles/general-art-articles/damien-hirst-auction.html

http://www.time.com/time/magazine/article/0,9171,1838750-3,00.html

http://www.artquest.org.uk/articles/view/beautiful-inside-my-head-forever1

http://artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/

http://www.time.com/time/video/player/0,32068,1774353335_1839008,00.html

One of the major benefits that Hirst seeks to reap by selling directly to auction is that he can avoid the significant loss of profits (30%-50%) that usually go to the dealers, sellers, and the auction house. Typically, artists don’t get anything from auction sales of their work, so by selling directly, Hirst can obtain a significant increase in revenue from sales2. Not only will he get more money, Hirst will get more exposure. Selling at Sotheby’s is a good way for him to get his name out to new, international buyers2. The auction has a “global reach” and this can not only expand Hirst’s following but it can also increase the numbers of players (buyers, dealers, etc) in the art market and yield more revenues from countries abroad. These international buyers can also help Hirst solve the alleged issue of excess inventory. In August 2008, Art Newspaper reported that Hirst’s London gallery White Cube had a backing of over 200 of his unsold works worth more than $185 million” It is not for sue whether this is true or not but if it is than he is definitely suffering from that problem. If this is true, selling at auction can help to alleviate this problem.

Despite the benefits of selling directly to auction, there are some disadvantages that both Hirst and the art market can experience. Hirst’s public image and relationships could be shattered. The selling at Sotheby’s appears to be the final big move by Hirst, marking the beginning of the end of an aspect of his career*.* For many years now, the quality of Hirst’s work has been fluctuating. There have been ambivalent feelings about his works and this has been reflected in recent sales prices for his pieces at auction. Selling at auction could be the Hirst’s last stand to obtain revenue from his seemingly less popular works. In another instance, by selling to auction directly he risks the chance of offending his dealer by excluding them from his sales process. Despite this, he claims that he will continue to work with two of the most prominent dealers in the art world, Larry Gagosian and Jay Jopling. For other artists they might not be as lucky to have such world-renowned dealers on their side.

I do think that Damien Hirst has overexposed himself. It seems as though he has an insatiable desire to be in the public arena. The public is always discussing Hirst and his shocking and unique style of art. This constant shock value he delivers the public is tiresome and evident from his decline in sales at auction. According to writer Katherine Jentleson in an article titled Beautiful Inside My Head…Whatever, the average price for works by Damien Hirst has been declining1. In early 2008 before September, the price for Hirst’s butterfly paintings was around $2 million. By the time September came around, the price for those butterfly paintings had dropped dramatically to less than $1 million1. In 2009, the price for these works hovers around $700,0001. The same downward trend is observed for Hirst’s spin and spot paintings, both of which had peak sale prices in September 2008 and have since plummeted. It appears that the public is looking for something else from Hirst, or just disinterested totally. Hirst seems to have burnt out. The overexposure, previous disorderly behavior, and outrageous works are very last season. I think Hirst tried way too hard to make a name for himself and went about it in a way such that it brought into question whether Hirst himself “actually knows what to do with a brush” since he seems to create works of art mechanically or not by his own hand2.

References:

1http://www.artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/

2http://www.time.com/time/magazine/article/0,9171,1838750,00.html#ixzz1jtokWCOU

On the one hand, it created some negative publicity for the artist, and probably for the art market as well. For example, The Economist magazine said that for Hirst, “another Beautiful sale could be ugly” (Economist, 9/10). Yet, the fact is that 39% of the buyers at the Beautiful Inside My Head Forever auction never previously purchased any contemporary art and 24% of them were first time customers for Sotheby’s. (Economist, 9/10). So the auction was, to some extent, a positive for the art market. No matter what, I think it will likely go down as one of the most controversial auctions of all time; in large part because of Hirst’s own desire to create attention, and undoubtedly, make as much money as possible for himself.

I think Lacayo’s comment in his Time Magazine article described Hirst well when he said that as much as a financial victory the sale may have been, it may also have been a “terminus, a house-cleaning by a man overtaken by his own success.” That probably explains why his auction sales are now “sputtering.” (Jentelson, 1). It seems to me that Hirst got caught up with himself and making as much money as possible. Why else would he go against the established artist-dealer means of doing business, which he knew worked just fine and had already helped make him a rich man? While auction brought in approximately $200 million, he had to know that he was creating an instant “glut” of his works in the market place. While some have said the idea for the auction was that of Hirst’s business advisor, I have to believe that Hirst’s ego had a lot to do with it.

Here is the Art Market Monitor’s list of the major sales at the auction:

Here is a YouTube video of the top selling piece at the auction – The Golden Calf.

In hindsight, I think Hirst got lucky with the auction. The financial crisis was just beginning and Hirst was still at the top of his game, in terms of notoriety and sales, at the time of the auction. Also, I think it’s uncommon for an auction house to sell primary works unless it is for a charitable purpose. But Hirst was flying high at the time and he was able to pull it off. While I think the end result was more negative than positive for the art market, it’s impossible to deny that it was basically a big positive for Hirst himself – despite the fact that his sales have plummeted since the auction. While his sales decline is probably the product of the economic downturn combined with the fallout from the auction, one thing is certain – Hirst made a lot of money. By increasing the price for his primary work (albeit at the expense of his future sales market), he was able to successfully complete an auction with almost $200 million in sales. By any standard, and even for an already rich person like Hirst, he became a lot richer after the auction, especially if it’s true that Sotheby’s waived the seller’s fees. And his works, while now bringing in a lot less since the auction, are still performing better than the S&P 500 - but not nearly as good as the Artnet index as shown in this chart from Thomson Reuters.

So, I do think that Hirst over-exposed and over-produced himself and his artwork. But it’s hard to second-guess an artist who pulled off a $200 million auction in just a few days. As for the art market as a whole, the pros and the cons seem to have balanced themselves out. While I’m not so sure that Sotheby’s will ever become a major seller of primary artwork, it certainly did give the branded auction house a lot of press, which is usually a positive. Even though Hirst went against the grain of the artist-dealer model by going straight to the auction house, it doesn’t seem that he started a trend.

There were also cons of the auction. While Hirst gains control of his art financially, he loses the control that dealers exert on the market by their careful placement and limiting of art so as to increase and preserve its value. This loss of control of the distribution of art can lead to the market being flooded with readily available art for a wide audience which can lessen the demand for and value of the work. In addition, an artist taking their work straight to auction could alienate dealers and make enemies of powerful people in the art market who could withdraw support from an artist.

Although the Hirst auction was successful, it does seem that he overexposed himself and his art. The graphs in the Art Market Monitor article clearly demonstrate a downturn in the demand for his work and the prices paid for it. Although some of this may have been caused by the coinciding market crash, I think much of it can be attributed to overexposure. There are a limited number of people in the world who can afford to buy such expensive art and once they have satisfied their desires for works by Hirst, who will be left to buy the art? While I would describe Hirst as a marketing genius rather than an artistic genius he may have made a marketing mistake with the auction. The value of Hirst’s work previously was very much dependent on the careful control of supply. With patrons treating art as a commodity more than ever before, the value of art depends largely on its demand which is higher when less work is available.

While Hirst may have made a misstep with the auction, his brand seems to be have survived quite well. He currently has a worldwide exhibition of spot paintings, “Damien Hirst: The Complete Spot Paintings, 1986-2011” that is receiving, as usual, plenty of attention. While the auction may have negatively affected the value of his work, it does seem to have achieved wider visibility for the Hirst brand. Interestingly, at the upcoming contemporary art auctions at Sotheby’s in February, more Hirst pieces are available at the day auction than the more prominent evening auction and the prices continue to be low. The one exception is a spot painting for the evening show that is estimated at $500,000 - $700,000; this is a modest increase from the 2009 lows shown in the graphs.

A review of Hirst's current "Complete Spot Paintings" exhibition:http://latimesblogs.latimes.com/culturemonster/2012/01/art-review-damien-hirst-at-gagosian-gallery.html

Damien Hirst and his "Golden Calf"

Hirst’s direct association with Sotheby’s increases his financial return by eliminating the involvement of a dealer who can take up to 50% of the total sale. It also makes his works more available for sale to a wider range of buyers. Often times dealers are selective as to whom they sell because they want the artworks they sell to end up in a prestigious collection or museum so that they have impeccable provenance, which brings the dealer good reputation. However, this is not always what the artist wants -- Not Hirst, anyway. Since at auction, anybody who bids the highest wins, there are no restrictions as to who can buy certain works. This is more profitable for the artist because this is where and when the wealthy without a respectable collection or power desired by the dealers can buy whatever they want and they will bid high. It is likely that a work of art would sell at a higher price at auction than it would have in a gallery because at auctions, competition is high and there are many factors like the way the auctioneer leads and steers the auction that can affect the outcome. Moreover, since the fee paid to the auction house is paid by the buyer (buyers’ premium), the price at which the auctioneer’s gavel comes down is what the artist garners for himself. There is no doubt that Hirst has exceptional marketing and entrepreneurial skills. Whether he is a “good” artist is another matter. He completely discarded the traditional qualm and cautiousness of artists about seeking a large profit through selling art in fear of soling the purity of art and openly turns his art into commodities. Not only does he repeat and mass-produce his works, he also does this by the hands of others – his 120 assistants. Many artists would view him as a con-artist.

Hirst’s dealers – Gagosian and Jopling – were also probably unhappy about Hirst’s overstepping them and going directly to the auction houses. Hirsts’ behavior has proven to be profitable on his part, but in context of the market as a whole, such behavior can be unhealthy for the market. Auction houses’ stepping out of their old boundaries by selling works fresh off artists’ studios threatens the position of the dealers. It destroys order within the art world. Also, artists who bypass the dealers, with money as their foremost goal, are likely to fall into the dishonorable trap of vanity that makes producing “good” art difficult.

Hirst, a deft entrepreneur of his brand, was not perfect, however. Considering the huge success of his September 2008 auction, the decline in demand for his works may seem surprising. His market index was inconsistent throughout, and after the 2008 auction it plummeted below that of contemporary art. The number of his paintings bought in at auctions also increased from 2007 and all throughout 2008.

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.11.15-AM1.png

http://artmarketmonitor.com/wp-content/uploads/2010/02/Screen-shot-2010-02-06-at-10.10.24-AM1.png

What does this all mean? Perhaps this plunge suggests that he went too far, or rather, too fast. The market seems to have had enough of the spin and spot paintings. He couldn’t just keep pumping them out forever. Obviously caused by a huge pile of unsold works in his studio, Hirst considerably reduced the size of his group of assistants and announced that he would stop making spin and spot paintings (Henry). However, what I see as his bigger failure than the overproduction problem is that, by reverting back to the traditional paint-on-canvas paintings and saying heedless things about his previous works, he discredited his own works. In my opinion, when an artist confesses that he gave up painting because had tried to imitate some painter but failed is giving up at being a serious artist. When he finally picked up painting again, he had already created a very distinctive image of himself as a different, rebellious artist that goes against the grain, and his attempt to re-establish his status in the art world as a painter was not something that people wanted. He said himself that his spot and spin paintings were a “mechanical way to avoid the actual guy in a room, myself, with a blank canvas,” a statement that strips these early works of the little meaning they had in the first place and debases the unorthodox principles he seemed to believe in to merely a pathetic escape from what he couldn’t achieve due to his incompetence. Hirst was not the only one who was skeptical about his paintings. Critics, calling his paintings in the 2009 exhibition No Love Lost, Blue Paintings "deadly dull and amateurish", "dreadful" and "not worth looking at," seemed to have really hated it, too (Nikkah).

Hirst’s painting

http://4.bp.blogspot.com/_rOmV6dySOPU/SuDF77ly_dI/AAAAAAAACXc/Lo5UNgCgf8c/s400/HirstPainting.jpg

Works Cited

Henry, Julie. “Damien Hirst lays off workers.” The Telegraph. 22 Nov. 2008. Web. 19 Jan. 2012. <http://www.telegraph.co.uk/finance/financialcrisis/3500553/Hirst-lays-off-workers.html>.

Jentleson, Katherine. “Beautiful Inside My Head…Whatever.” Art Market Monitor. 6 Feb. 2010. Web. 19 Jan. 2012. <http://artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/>.

Lacayo, Richard. “Damien Hirst: Bad Boy Makes Good.” Time Magazine. 15 Sept. 2008. Web. 19 Jan. 2012. <http://www.time.com/time/magazine/article/0,9171,1838750-3,00.html>.

Nikkah, Roya. “Damien Hirst's 'dreadful' paintings draw record crowds.” The Telegraph. 18 Oct. 2009. Web. 19 Jan. 2012. <http://www.telegraph.co.uk/culture/art/art-news/6360352/Damien-Hirsts-dreadful-paintings-draw-record-crowds.html>.

It seems that this has not been the case. Hirst's “Beautiful Inside My Head Forever” auction marked a sort of last hurrah for the artist. He enjoyed phenomenal, record breaking sales. His work, The Golden Calf, went for 18.5 million, beating Hirst's own record of 17.2 million for a work of his sold the previous summer [3]. But since the historic sale, he has significant decreases in sales of other works. In following auctions, about two- thirds of his work were bought-in [2].

Perhaps Hirst has just been pushing the limits for too long and his straight to the auction house approach was the last straw. Artists never go straight to auction, as a rule. It would make them appear too eager for money and would likely decrease the value of their works. Perhaps Hirst was able to initially get away with this as a result of his major success, and because his works deal directly with issues of commodification. Since Hirst's show, there has been much talk about the implications this event held for the rest of the art world. Would it be possible for others to bypass the system? This would be a dealer's nightmare. Usually profit is split fifty-fifty between artist and dealer.

It was speculated that other big name artists, such as Jeff Koons, might try the same method. But others are wary. And in light of Hirst's plummet, it is unlikely that others will ever consider going straight to the auction house.

Another factor that likely contributed to Hirst's market decline was his overproduction. At the height of his success, he employed about 120 people to assist him with his work [1]. It is rumored that his gallery, White Cube, in London, is holding over 200 pieces of his unsold works [1]. If these rumors are true, perhaps it is the sheer quantity of his work that is devaluing itself.

It may also be that Hirst's attitude toward his own works are hurting him. In an interview with TIME just before the “Beautiful Inside My Head Forever” sale, Hirst stated that he has really only done about four good pieces, including the Golden Calf, and the rest of it is just sort of “puff” [4]. In regards to one of his spot paintings, he describes it as looking “kinda 60's” In another TIME interview, he says of his work, "The spot paintings, the spin paintings... they're all a mechanical way to avoid the actual guy in a room, myself, with a blank canvas." [1].

Since Hirst's decline in popularity over recent years, he has begun painting with his own hand again. Will he be able to show the market that he is capable of this kind of art? Will his fame as a factory style artist overshadow his other artistic attempts? Or will Hirst simply be unable to prove himself as an actual painter? Consider his “No Love Lost” show at the Wallace Collection in London. In a review of the show, the Independent ran an article titled “Are Hirst's Paintings Any Good? No, They're not Worth Looking At.” The article is summed up at the end with “the freak show goes on” [6].

[5]

Perhaps Hirst will never regain the commercial success that he enjoyed up until his “Beautiful Inside My Head Forever” show. Perhaps it will be a long time before we see another artist of such rock star magnitude that will try to turn the artworld on its head.

[1] http://www.time.com/time/magazine/article/0,9171,1838681-2,00.html

[2] http://www.artmarketmonitor.com/2010/02/06/beautiful-inside-my-head-whatever/

[3] http://www.luxist.com/2008/09/15/hirsts-golden-calf-sells-for-record-breaking-18-million/

[4] http://www.time.com/time/video/player/0,32068,1774353335_1839008,00.html

[5] http://www.wallacecollection.org/collections/exhibition/77

Damien Hirst is one of the wealthiest contemporary artists to date, and he is most noted for his auction, The Beautiful Inside My Head Forever Auction, however since this auction his art pieces have never been as successful. What made this auction so unique was that Hirsts' pieces went directly to auction, and never were handled by a dealer. This is unprecedented, and somewhat taboo in the art world, however, for him, it proved to be very profitable.

Artists never go directly to market, because it bypasses the need for a dealer, and often makes one seem as though they are simply creating art in order to sell their pieces for the most money possible, and keep all of the profits for themselves, instead of splitting it 50/50 with a dealer. This shows to the audience that the artist is greedy, and does not care to follow the rules, but rather undermines the art market system in order to solely benefit himself. Through this method, Hirst hurt his reputation along with burning any relationships he may have had previously with dealers, and any potential for new relationships within the art world. It is clear he followed his large ego in this situation, believing himself to be above the system, and independent and popular enough to survive without any relationships with dealers.

The Art Market also discouraged of this method of selling his pieces because they state that it harms their business because it undermines their authority. Now artists might think, Hirst was extremely successful selling straight to auction, why can't I be? Thus, the art market suffers while the artists gets a large payoff. This however is not entirely true. Although it did succeed in this one example, Hirsts' works since this auction have declined, which may be a direct correlation to his large ego and his manner of selling his art. Other artists may see this and not want to repeat Hirst's mistakes. Also, many of the people who bought at the Beautiful Inside My Head Forever Auction were first time buyers, thus bringing new people into the contemporary art world.

Not only did Hirst hurt himself through this auction, he also slandered himself in Times Magazine, stating that he only truly thought four of his pieces were worth anything and the others were just "puff". Through this, his fans and audience may feel hurt that Hirst does not even think highly of his own work, but boldly discusses his factory style work, and describes his own pieces, which they may be attached to, as puff. By doing this, he further isolates himself from his fans, and bolsters peoples' opinion that he is solely making art for the profit. Hirst also may have overexposed himself, by putting too many pieces out at once (a simple feat seeing as he employs around 120 people to make his art), he has given too much supply to a market that does not have sufficient demand.

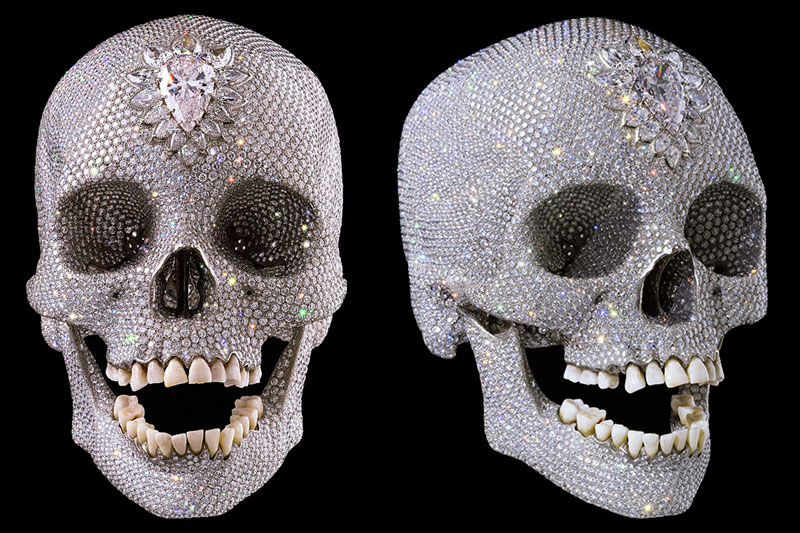

The Golden Calf, one of the four pieces Hirst believes is worth anything.

Now however, Hirst is rebounding through making his own paintings again, and by participating in the market in a less taboo manner. Either way, Hirst has definitely set new standards for creating and marketing contemporary art.

As everyone will, if a market for “goods” is in high demand, the desire to make more to meet the demand is what is most likely to be done. That way, there is always something to give when it is requested for. When I was in Rome, I interned with an artist, whose works cost 14,000 to 20,000 euros. He always made sure he had a number of works already made when demand was high and in the low season we worked on new ideas. In the case of Hirst, he might have over produced too much. Art lovers are such that with time they begin to look for a new style from the same famous artists whose works they buy and if the artists do not come up with new ideas, the same old art becomes boring and the market for that becomes slow. Hirst certainly overlooked that and thought that with how much he was making for these pieces, they were hot cakes and he overproduced them.

I can’t be happy enough to express my joy for Hirst’s “Beautiful Inside my Head Forever” not because it made a sale of almost $200 million, but because for the first time, an artist has gone out of the box and circumvented the galleries who almost always ends up with about half of what the work sells for. Most people think that Artists have an objective view such as creating fame or pleasing a certain audience who expect some sort of ideal art, or even that artists wish to become part of a history that can be modified by anyone. One thing that caught my attention was when it was said that Hirst said “I hate the way when you walk into a gallery and say you want to buy a Damien Hirst they say: 'Who are you?' I much prefer to be in a shop where you can just go in and buy it." To me, this says a lot about Hirst. He is doing art for the sake of its appreciation and for the love for it. I wouldn’t want to say that it is quite unfortunate that people have placed a high value on his art and has in turn made him to look like an artist looking for money. Hirst, has started having low sales on his work and the interesting to me is that in all of his interviews, he has not mentioned or shown worry about the fact the his works are not selling as high as they used to. The people who are sounding the news of this are the very same people who added value to his work. An artist is free to do what he wants because it is coming from the heart. Normally most an artist turns to specialize in a medium or two mediums or even more. Damien hirst is a sculptor and the fact that he is trying to paint does not mean he has to do so to please what the public wants from him. Artist are curious, and like to explore, most artist, once they gain public recognition become acquainted to the style that made them successful and for most of their artistic carrier do not try something new. Hirst on the other hand seems to be doing what he wants to do, something that makes him happy first, especially as he looks to an artist that greatly influenced him, Francis Bacon.

Prior to reading this, I was not a fun of this man “Mr Damien Hirst” but after the reading, I am a fun not only because he has set new standards in the art world, but I tend to also find him rather humble and still inclined to what art really is, as most people will have turned on a newly complete lifestyle.

And he has a sense of humor too.......

- Selling to Sotheby’s was the prefect-marketing tool and garnered him massive exposure to the international art market. The auction house has an international market and can expand Hirst’s the amount of buyers and dealers who are exposed to Hirst’s work.

- By going to Sotheby's Hirst avoided the dealer, seller and auction house commission, typically 30%-50% of profits. Artists don’t make any money on the sale of their works at auction thus by selling his paintings directly to Sotheby’s he made profit. Not only did Hirst get money he got something perhaps even more coveted, attention.

Some disadvantages Hirst encountered selling directly to auction was a blow to Hirst’s public image. Many people believed he seemed only eager to make a profit thus devauling his work. Hirst's “Beautiful Inside My Head Forever” auction did break record sales, The Golden Calf, sold foor 18.5 million; however, since breaking his own record his sales have declined- in later auctions, almost half of his works were "bought-in."

I do think that Damien Hirst is overexposed and over-produced. Hirst frequently utilizes shock value in his work, as evident in A Thosand Years (1990), which features a severed cow head. This purely shock-producing attention-seeking style has become tiresome as evident from his decline in sales at auction. Hirst’s spin and spot paintings, both of which peaked in price in 2008 and have since plummeted. on January 12, 2012 Gagosian Gallery launched massive spot painting shows in all their galleries, likely in hopes to reinvigorate the spots or to get rid of Hirst's work. This Gagosian show has garnered all sorts of positive attention since launching a couple weeks ago, however this seems like one final jaunt before Hirst burns out. There are hundreds of paintings that have been divide up between Gagosian's several galleries. I believe the sheer quantity of his work is actually devaluing itself.

A Thosand Years (1990)

The opening of "Damien Hirst: The Complete Spot Paintings" at Gagosian's beverly Hills gallery.

In conclusion, Hirst’s decision to go straight to auction made appear too money hungry and actually caused a decline in the value of the works. At first the auction strategy worked as it shocked people and had never been done before, however his works became purely a commodity with very little focus on the artistic value of his works.

One of the most taboo subjects to talk about in the art world is money, however Hirst’s unabashed lust for the money is something that the art world seems to be ultimately confused about. Many writers tell the world about the plight of artists and how dealers, galleries and auction houses reap what is rightfully theirs. Yet Hirst is seen in a different light, one which does not actually produce real art and is so focused on money that it completely taints the art world.

Hirst has relied on Frank Dunphy who is more than an accountant and instead acts as business manager. Dunphy has pushed galleries and dealers for margins of 70% up from the normal 50%. This business approach to art sales has pushed Hirst into borderline consumerism. Some of his most controversial pieces have had a hard time selling. His work, For the Love of God which had an initial price tag of $100 million, however was eventually bought by a syndicate which includes Hirst himself. The syndicate believes that the piece would sell at $200 million right now.

His past sales have actually fallen which lead some in the art world to believe that he has been overexposed. I find it interesting that the art world suggests that he is overexposed and not just that his art has fallen out of favor with collectors. As seen in the graph below, it is clear that the prices of his paintings have fallen greatly since his Beautiful Inside My Head Forever auction. The auction marks the end of the pre-crisis art auction period, in which the most millionaires and billionaires were able to collect art.

Hirst has opted for auction houses over galleries, driving up margins however pushing his art into an interesting hybrid of a normal primary market and and auction house. There are many positives to this approach. Often, galleries take a large cut, roughly 30-50% of the sale of art. By going to auction, Hirst removes the power from the dealers and gets nearly the entire gavel price at auction (buyer paying a percentage over the end auction price to the auction house). He has successfully changed the bargaining power of the modern artist, and given the people what they want now, rather than featuring his pieces in an ultra upscale gallery which is more worried about who is buying the pieces and if they will automatically go to the secondary market.

There are also cons to Hirst’s methodology. As we have discussed in past lessons, the auction house if often used as a barometer for the overall popularity and skill of an artist. If prices fall, it indicates that the artist has fallen out of favor. While Hirst brings his works to market through the auction houses, the same principle applies. If his art does not sell at auction, it is seen as a failure, as falling out of favor with collectors in the art world. There is great risk associated with this, as galleries do not have a small window to sell pieces, and art work can sit in a gallery for months or years before being sold to the right collector.

Hirst’s system also removes the illusion of the art market for many of the other artists. By focusing on the returns from his auctions, Hirst puts a bad spin on the art world, signaling to the collectors that this work is not about the art itself, but the impression it makes on possible collectors. Part of the allure of auction houses is that normally they sell only the most reputable art, a sort of ritual hashing which gives collectors the best possible selection. Instead, Hirst mass markets his work, and collectors are left wondering how much more of the same there is to come.

I think it is interesting to see the way Hirst and Warhol are perceived. Both artists used a factory style production method and create/d provocative pieces. Yet Warhol is credited with making grandiose statements about consumerism, and Hirst is seen as the art world’s vilified example of consumerism. One of the illusions of the art world is that the art market is liquid. One of a kind pieces by definition make the market illiquid. The feeling and emotion one gets from the work cannot be quantified, and the social aspect of the auction scene takes collecting to another level. The overexposure of Hirst actually makes his work more liquid. Hirst himself is the best social commentary on consumerism within the art community. His art work parallels what the art market has become, an investment. His works evoke emotion and bring up interesting commentary on life, however the focus on his prices show they are as much of an investment as they are art. The prices for his work rise and fall as do other artists, however it is not based on quality of the piece for sale, or the trending art style, but the market share of the artist.

One quote that I loved in the Time article was Hirst saying, "I grew up in a background of people who weren't into art," he recalls. "They'd say: 'If you can do a drawing that looks like me and you can put it in a pub and people think that's me, that's art. Not what you do.' So I was always fighting for art, trying to push things forward." I believe he certainly has pushed things forward in his methodology and marketing.

Consider & comment:

Please use this space to respond to your classmates' work and to engage in lively discussions on the day's topic. Keep your comments concise and conversational by responding to others, rebutting or supporting their ideas. Use the comment box below for these observations.