A great irony regarding the art market and art in general is Damien Hirst. How Hirst conducts business and how the media covers him shows the art market’s perpetual teeter on consumerism, and the double standard for artists and their galleries.

One of the most taboo subjects to talk about in the art world is money, however Hirst’s unabashed lust for the money is something that the art world seems to be ultimately confused about. Many writers tell the world about the plight of artists and how dealers, galleries and auction houses reap what is rightfully theirs. Yet Hirst is seen in a different light, one which does not actually produce real art and is so focused on money that it completely taints the art world.

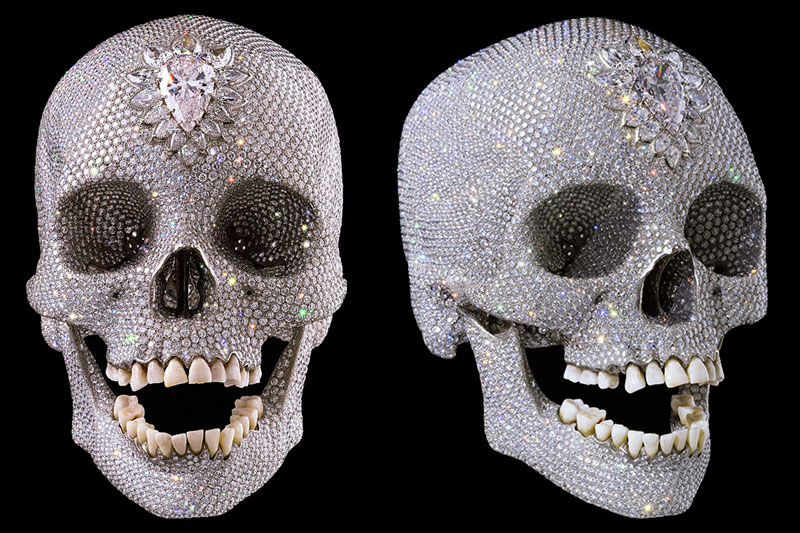

Hirst has relied on Frank Dunphy who is more than an accountant and instead acts as business manager. Dunphy has pushed galleries and dealers for margins of 70% up from the normal 50%. This business approach to art sales has pushed Hirst into borderline consumerism. Some of his most controversial pieces have had a hard time selling. His work, For the Love of God which had an initial price tag of $100 million, however was eventually bought by a syndicate which includes Hirst himself. The syndicate believes that the piece would sell at $200 million right now.

His past sales have actually fallen which lead some in the art world to believe that he has been overexposed. I find it interesting that the art world suggests that he is overexposed and not just that his art has fallen out of favor with collectors. As seen in the graph below, it is clear that the prices of his paintings have fallen greatly since his Beautiful Inside My Head Forever auction. The auction marks the end of the pre-crisis art auction period, in which the most millionaires and billionaires were able to collect art.

Hirst has opted for auction houses over galleries, driving up margins however pushing his art into an interesting hybrid of a normal primary market and and auction house. There are many positives to this approach. Often, galleries take a large cut, roughly 30-50% of the sale of art. By going to auction, Hirst removes the power from the dealers and gets nearly the entire gavel price at auction (buyer paying a percentage over the end auction price to the auction house). He has successfully changed the bargaining power of the modern artist, and given the people what they want now, rather than featuring his pieces in an ultra upscale gallery which is more worried about who is buying the pieces and if they will automatically go to the secondary market.

There are also cons to Hirst’s methodology. As we have discussed in past lessons, the auction house if often used as a barometer for the overall popularity and skill of an artist. If prices fall, it indicates that the artist has fallen out of favor. While Hirst brings his works to market through the auction houses, the same principle applies. If his art does not sell at auction, it is seen as a failure, as falling out of favor with collectors in the art world. There is great risk associated with this, as galleries do not have a small window to sell pieces, and art work can sit in a gallery for months or years before being sold to the right collector.

Hirst’s system also removes the illusion of the art market for many of the other artists. By focusing on the returns from his auctions, Hirst puts a bad spin on the art world, signaling to the collectors that this work is not about the art itself, but the impression it makes on possible collectors. Part of the allure of auction houses is that normally they sell only the most reputable art, a sort of ritual hashing which gives collectors the best possible selection. Instead, Hirst mass markets his work, and collectors are left wondering how much more of the same there is to come.

I think it is interesting to see the way Hirst and Warhol are perceived. Both artists used a factory style production method and create/d provocative pieces. Yet Warhol is credited with making grandiose statements about consumerism, and Hirst is seen as the art world’s vilified example of consumerism. One of the illusions of the art world is that the art market is liquid. One of a kind pieces by definition make the market illiquid. The feeling and emotion one gets from the work cannot be quantified, and the social aspect of the auction scene takes collecting to another level. The overexposure of Hirst actually makes his work more liquid. Hirst himself is the best social commentary on consumerism within the art community. His art work parallels what the art market has become, an investment. His works evoke emotion and bring up interesting commentary on life, however the focus on his prices show they are as much of an investment as they are art. The prices for his work rise and fall as do other artists, however it is not based on quality of the piece for sale, or the trending art style, but the market share of the artist.

One quote that I loved in the Time article was Hirst saying, "I grew up in a background of people who weren't into art," he recalls. "They'd say: 'If you can do a drawing that looks like me and you can put it in a pub and people think that's me, that's art. Not what you do.' So I was always fighting for art, trying to push things forward." I believe he certainly has pushed things forward in his methodology and marketing.